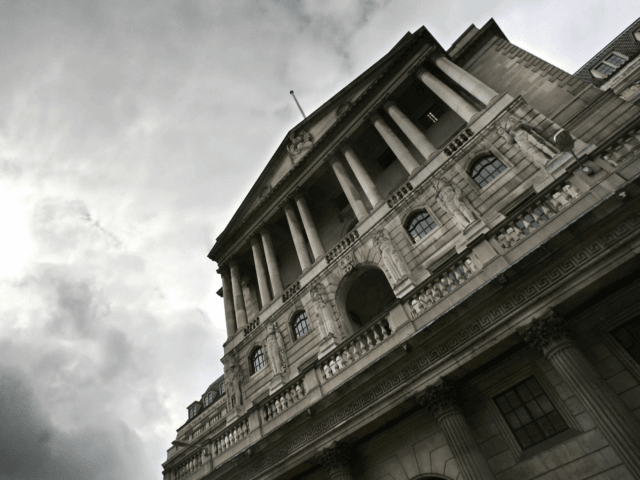

The Bank of England has warned that inflation could hit 8 per cent by as early as next month in Britain as it raised interest rates to pre-pandemic levels on Thursday.

The central bank of the United Kingdom raised interest rates to 0.75 per cent, marking the first time that interest rates rose to such heights since the start of the Chinese coroanvirus pandemic.

In an eight-to-one vote, only Deputy Governor Sir Jon Cunliffe called for rates to remain at 0.5 per cent, citing concerns over the growing cost of living crisis facing average Britons and the fact that a rate hike would negatively impact growth, The Times reported.

The move is seen as an attempt to the curb the spiralling inflation rates, which have been climbing over the past year following enormous government spending to keep the economy afloat during the government mandated lockdowns.

Inflation has been further exacerbated by the Russian invasion of Ukraine which has further destablised the European food and feul markets.

While previous estimates had forecasted that inflation would hit 8 per cent by the Autumn, the Bank of England said on Thursday that it could hit that level by as early as next month.

The central bankers went on to warn that inflation could rise “several percentage points” higher by October, when households will receive their energy bills for the first half of the year. The energy price cap — set by regulator Ofgem — is already expected to rise by 54 per cent in April, however, this will likely increase even more when it is set again in the Autumn.

Officials also admitted that there will be little they can do to prevent further shocks to the economy should the war in Ukraine continue, noting that because the United Kingdom is a net importer of energy, “monetary policy is unable to prevent” further price increases.

“Global inflationary pressures will strengthen considerably further over coming months, while growth in economies that are net energy importers including the United Kingdom, is likely to slow,” the Bankers said.

This week, the Trades Union Congress (TUC) said that energy bills are likely to grow at least 14 times faster than wages this year.

The government statistical agency, the Office for National Statistics (ONS), also revealed this week that the 3.8 per cent increases to wages were effectively wiped out by inflation, with the average take home pay — excluding bonuses — actually declining by one per cent in real terms, the sharpest decline since 2014.

Despite this, the government has refused to lift taxes on electricity bills, 30 per cent of which are handed over to the government in either taxes or directed towards subsidies for so-called green energy firms.

The government has also so far refused to reduce taxes — despite campaigning on tax cuts in their 2019 election manifesto — in other areas, such as the planned hike on national insurance payments, which the government has argued is necessary to pay for the backlogs at the nation’s socialised healthcare system encurred during the Chinese coronavirus crisis.

Prime Minister Boris Johnson, who, despite leading the Conservative Party, has been at the forefront of the Build Back Better movement to transition the UK’s economy to a net zero producer of carbon emissions by the year 2050, has attempted, and apararently failed, to secure more oil from Saudi Arabia this week, while still steadfastly refusing to open up natural gas production domestically.

Follow Kurt Zindulka on Twitter here @KurtZindulka

COMMENTS

Please let us know if you're having issues with commenting.