LONDON (AP) – The British government unveiled another massive income support scheme on Thursday, this time for the 5 million-or-so self-employed people, many of whom face financial ruin from the shock of the coronavirus pandemic.

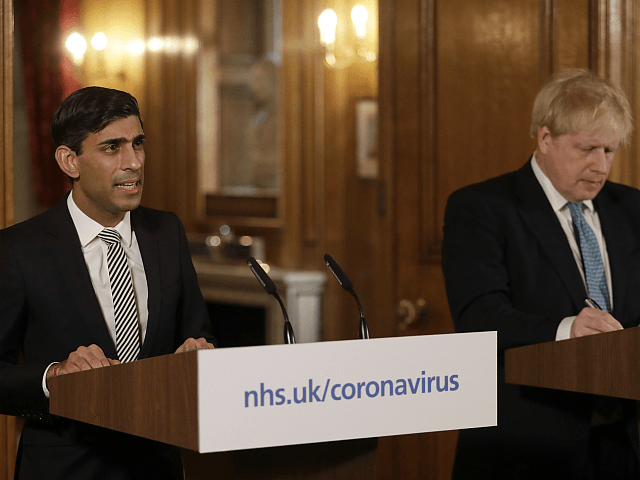

Treasury chief Rishi Sunak said the Self-Employed Income Support Scheme will replicate the one he announced last week for workers that firms retain rather than lay off. However, the money to the self-employed won’t be paid out until June, a delay that’s prompted concerns about how many will make ends meet in the intervening period.

Sunak said the government’s overall package of support is “one of the most significant economic interventions in the history of the British state.”

Since last week’s announcement to help those on the payroll, many self-employed people, such as cleaners, electricians and hairdressers, have been fretting about their financial futures in addition to their health. Those concerns ratcheted higher Monday when Prime Minister Boris Johnson effectively shut down much of the economy and imposed severe restrictions on people’s movements in a heightened effort to deal with the coronavirus.

“You haven’t been forgotten, we will not leave you behind, we’re all in this together,” Sunak told a virtual press briefing.

Sunak was speaking as government figures emerged showing that 578 people in Britain had died after testing positive for Covid-19, up 115 from the day before.

Sunak said the government will pay self-employed people adversely affected by the outbreak a taxable grant worth 80% of their average monthly profits over the past three years, up to 2,500 pounds ($2,975) per month. The total cost is expected to be around 9 billion pounds ($10.7 billion) if it only lasts for its anticipated three-month duration.

He said the scheme will cover 95% of Britain’s self-employed workers and will only be open to those who make the majority of their income from self-employment.

Though the support package was greeted positively, concerns have been raised about how the self-employed can survive financially until June when Sunak said the first payments should be made.

UK Music, the industry’s umbrella organization, welcomed the package as a “vital lifeline” for thousands, but urged the government to provide immediate financial support for those “battling to make ends meet” now.

Though Sunak said welfare benefits were now open to the self-employed until then, the sums available are potentially paltry in relation to the grants.

The government is clearly worried about the impact on the economy and how much unemployment could rise in coming weeks. Sunak said last week’s support package for those on the payroll has already saved jobs at the likes of brewer BrewDog and sandwich chain Pret a Manger.

Earlier, the Bank of England warned that the scale and duration of the economic shock will be “large and sharp but should ultimately prove temporary.” Its rate-setting Monetary Policy Committee said in a statement that the depth of the downturn will largely depend on whether job losses and business failures can be “minimized.”

Like other central banks worldwide since the pandemic spread viciously over the past few weeks, the Bank of England has slashed interest rates, reducing its main one to 0.1%, its lowest level ever. It has also expanded its bond-buying program by 200 billion pounds ($240 billion) and is offering hundreds of billions more in cheap loans to businesses.

It also said it stands ready to provide more support to ensure that liquidity remains sufficient and that borrowing rates don’t go too high.

COMMENTS

Please let us know if you're having issues with commenting.