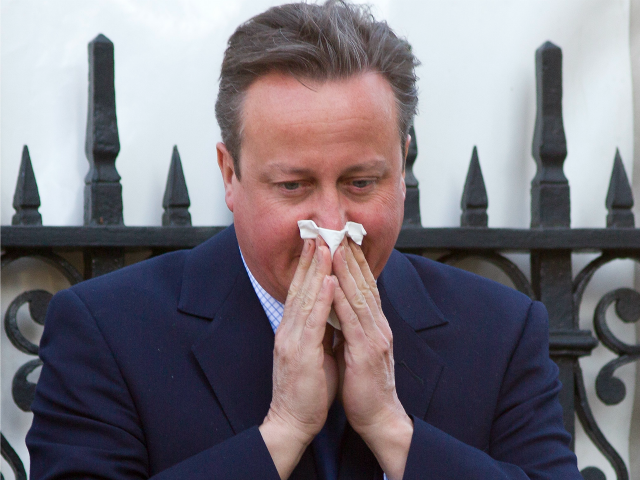

David Cameron’s Brokeback-Mountain-style relationship with the European Union (EU) is paying dividends: the pal he appointed as Britain’s EU Commissioner has ridden to the edge of the swamp, cast a lasso over the besmirched prime minister and begun heaving him out of the mire.

Well that would be my interpretation, anyway, of the news that EU Financial Services Commissioner Jonathan Hill is to make an important announcement today at the European Parliament in Strasbourg on the subject of “tax havens”.

Hill is Britain’s representative on the Commission and a close political ally of Prime Minister David Cameron who is under pressure in London for family links to an offshore fund exposed by the Panama Papers leak.

“This is a carefully thought through but ambitious proposal for more transparency on tax,” Hill said in a statement ahead of the plan’s release.

“While our proposal … is not of course focused principally on the response to the Panama Papers, there is an important connection between our continuing work on tax transparency and tax havens that we are building into the proposal,” he said.

Actually, though, when you look at the details of what is being proposed you realise it has little to do with Panama. Rather it concerns everyone’s favourite bugbear: greedy multinationals who don’t pay their “fair share” of tax in the various countries where they make their money.

Had the EU Commissioner announced a Europe-wide clampdown on paedophiles, or kitten abuse or muggers who attack little old ladies, he could scarcely have picked a target better guaranteed to court approving headlines. Which of course was always the point. And what of the fact that the Soros-funded Panama Papers leak has scarcely mentioned a single EU apparatchik, focusing instead on non EU member state Iceland, and indeed Russian President Vladimir Putin? Coincidence, or are Eurocrats all magically above board with their tax affairs?

And whither the Americans too? As Forbes notes. Could there be some collateral damage in the papers in the conveniently partial leak of these documents? Where’s the transparency from the partner organisations of the International Consortium of Investigative Journalists – the BBC, the Guardian, and Sueddeutsche Zeitung? (Anyone notice what these three have in common? Hint: They’re not exactly anti-EU outlets). Indeed Sueddeutsche Zeitung has already said it won’t publish all the files, arguing that not all are of public interest.

David Cameron is so personally invested in the campaign to keep Britain in the EU that its success depends to a great degree on how credible a figure he cuts. At the moment, thanks to the left’s cynical exploitation of his footling tax affairs, he is looking shifty and mendacious. (Which he is, it’s true: but this really shouldn’t have been the issue that caught him out). Hence the heavy fire support from within the EU – which is now portraying itself is a strong authority responding quickly to an issue of great public concern, in accordance with the views of the British prime minister.

In reality it will make little difference:

But in a disappointment to tax campaigners, the EU plan is largely limited to activity in Europe, except if those earnings come from a black-listed tax haven.

“As long as the proposal doesn’t cover all countries, multinational corporations will still have plenty of opportunities to hide their profits,” said Tove Maria Ryding, a tax specialist at the European Network on Debt and Development.

“So instead of solving the problem, this proposal would be moving the problem from one country to another, with multinationals still able to avoid taxes,” she said.

Bad luck, Ireland. Seems you may be about to lose quite a bit of trade to Hong Kong and various banana republics.

COMMENTS

Please let us know if you're having issues with commenting.