Another week in which European inflation data dominated the headlines, following an unexpected slip by Spain in to deflation (down 0.2 percent), saw pressure mount on the ECB to undertake some kind of intervention- and fast- to avoid the region stumbling in to deflation.

For the highly indebted nations, deflation would be an absolute disaster given the extra pressure it would place on their burgeoning debt servicing costs.

Crucially, the week saw Jens Weidmann, the head of the German Bundesbank say that quantitative easing was not “out of the question”. Given that the Bundesbank has previously been the biggest critic of monetary easing by the central bank, this is potentially a significant change in stance by Germany.

Monday 31st March (09:30GMT): UK Mortgage lending – Forecast increase of 75,250 mortgages approved against a previous approval rate of 76,750.

As it was, this figure came in well short of expectations at 70,310. This may be indicative of one of two things – either that November’s cessation of ‘funding for lending’ for household lending (including mortgages) is impacting the supply of mortgages that banks are able to approve, as well as pending changes that will require banks to test that customers can still afford mortgages in the event of a rate rise from April.

Alternatively, it may be indicative that 2013’s 8.4 percent rise in house prices is stretching borrowers’ incomes too far.

Also, Eurozone inflation: Forecast rise of 0.6 percent and came in at 0.5 percent for the year.

Above: A Clear trend- The Eurozone is careering towards deflation, particularly if energy prices continue to fall.

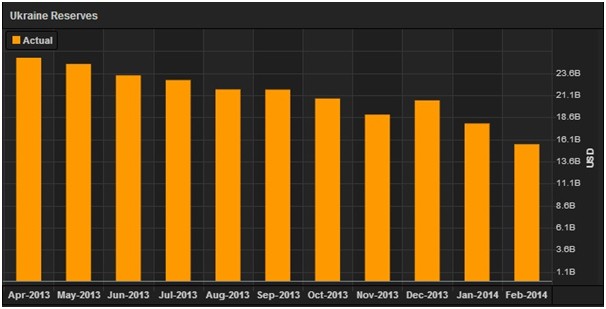

Tuesday 1st April (01:00GMT): Ukraine gross Forex reserves.

This isn’t a new problem, but Ukraine has been burning through its Foreign exchange reserves for the last year now, having gone from having $25 billion in its coffers during April last year to $15.5 billion now – a decline of 38 percent. A further decline will heighten the risk of a run on the Ukrainian currency, the hryvnia.

The importance of an IMF aid package being dispersed as soon as possible shouldn’t be underestimated and a shortfall of the reserves announced on Tuesday could accelerate the process.

Above: A picture of dwindling reserves in the Ukraine

Wednesday 2nd April (15:00 GMT) US Factory orders:

The US isn’t looking quite so resilient following the commencement of tapering and it remains to be seen if this third effort to wean the US Economy off of life support via Quantitative Easing will be any more successful than the previous attempts.

US factory orders will be one indicator as to how buoyant the market is as well as how confident business are, or if confidence is starting to take a knock following a slowdown in housing starts.

Thursday 3rd April (10:00 GMT) ECB rate decision:

There is speculation that the deposit rate of the European Central Bank could be cut to negative rates from its current 0.25 percent. This would effectively charge banks to keep money at the ECB in a desperate bid to get Eurozone banks lending to the real economy, or at least not just sitting on reserves at the Central Bank.

Furthermore, it may be employed as a means of devaluing the Euro, which would mean a cut in the rates would be a boost for European exporters. This may add froth to the price of those engaged in exports of goods, but it would also potentially provide a knock for banks who would have to take on additional risk in order to maintain their levels of return.

Friday 4th April (13:30 GMT) US non-farm payrolls:

Some may well remember the months prior to tapering when this would send the market bananas as everyone attempted to second guess the figure that the announcement on the commencement of tapering was tied to.

Although not quite as much scrutiny is attached to this announcement in months gone by, it is still an important barometer for the pace at which the Federal Reserve will ease the US financial system off quantitative easing.

This month’s figure is forecast show an absolute increase of 200,000. Last month was the first time forecasts were exceeded in the previous three months, which could indicate a bit of momentum coming back to the jobs market following tapering and a cold winter. One to keep a close eye on though.

COMMENTS

Please let us know if you're having issues with commenting.