The markets are crashing. The economy is on the verge of a recession based on a fair reading of the economic data.

Years of Bidenomics—high taxes, massive spending, loads of unnecessary and woke regulations that envisioned an expensive electric car in every garage that made it unaffordable to put a chicken in any pot—is finally being exposed like Sleepy Joe’s mental decline and Kamala Harris’s inability to string together a coherent thought.

On top of that we now have the Kamala Crash, a sharp decline in stocks as traders digest the very real possibility that the mainstream media will paper over the horrible Biden-Harris record on the economy so much so that the economic dingbat now at the top of the Democratic ticket will be elected president. It’s a scenario I foreshadow in my book that comes out tomorrow, Go Woke Go Broke; The Radicalization of Corporate America.

The Biden administration, Joe Biden, and Kamala Harris—with a huge assist from corporate America—attempted one of the greatest remakes of the economy not seen since FDR. At least Roosevelt had an excuse: the Great Depression. Biden and Harris inherited from Donald Trump economic growth and a country recovering from a deadly pandemic. They took an improving post-Covid economy and used Democratic majorities in Congress to shove left-wing policies down the throats of the American people who just wanted normalcy after a few chaotic years.

Here’s normalcy Biden-Harris style: With the help of asset managers demanding that companies embrace ESG investing that discourages oil companies from doing what they’re supposed to do and drill for oil, the Biden administration took spending to new and absurd heights, financed it through gimmickry rolling over of short-term debt to hide its immediate impact on interest rates, subsidized money-losing industries, gave away free stuff, and forgave student loans.

It worked for a while, but all the free spending (plus easy money from the Fed) began to unravel the economy first by imposing a pernicious tax on the working class known as inflation. Because Biden and Harris refused to aid the supply side of the economy to quell inflation (i.e., cutting taxes and regulations), the Fed was the only game in town. It raised interest rates so much that the inevitable is happening as I write this: an economic slowdown while prices for the basics remain still too high for the working class to afford.

Biden and Harris fiddled while the economy burned—but some of the smart money saw it coming. As I point out in Go Woke, Go Broke, a few of my sources saw through the muck when the trillions of Biden-Harris spending began to take shape, and their weird support of environmental edicts that suppressed oil drilling and incentivized car companies to make EVs no one is buying began stoking what the White House labeled “transitory inflation.”

One was James Gorman, the now retired CEO of Morgan Stanley. I describe him in my book as “easily one of the smartest CEOs on Wall Street because he must be.” I continue, “Morgan Stanley is one of the firms that brings Wall Street to Main Street. As CEO, he serves millions of individual investors through Morgan’s brokerage department. That means he and his team need to see through government spin on economic data. Gorman saw the orgy of spending for what it was: an idiotic cure looking for an economic problem that didn’t exist. A convenient excuse to further the expansion of government to meet the left’s political agenda of endless transfer payments, an EV in every garage, less oil exploration, tons more government spending, and of course, too much money chasing much fewer goods.”

Gorman had listened to the spin from the White House, the inept Biden-appointed Treasury Secretary Janet Yellen describing inflation as yesterday’s news, and the equally inept brat girl Kamala Harris explaining inflation as a malady where “prices are going up… that’s about the cost of living going up… It is something we take seriously.”

Let’s just say Gorman wasn’t impressed. Or as he told me during dinner in the summer of 2021, “I don’t believe any of this transitory inflation garbage… I can guarantee you that inflation is real and it’s going to be an issue.”

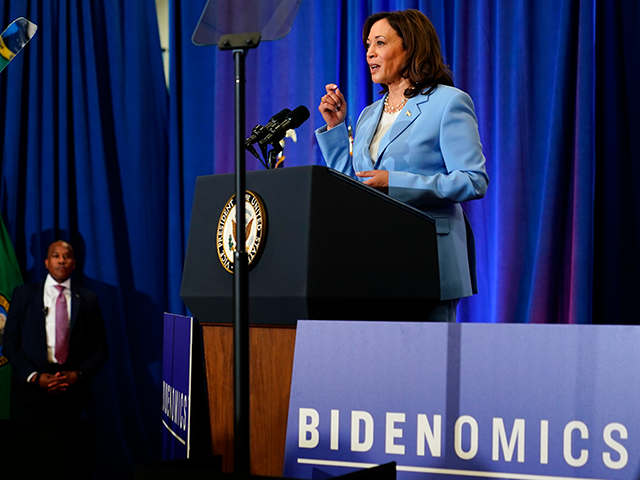

Vice President Kamala Harris gives remarks ahead of the one-year anniversary of the Biden administration’s Inflation Reduction Act on Aug. 15, 2023, in Seattle. (AP Photo/Lindsey Wasson)

And corporate wokeness encouraged by the Biden White House made it worse. The inflation we’re experiencing is going down, but only in terms of its rate. Prices are still higher today than they were four years ago, and one reason I point out in Go Woke, Go Broke is the overhang of ESG. With asset managers incentivizing companies to go green, cut back on oil production, utilize inefficient means to produce goods, the world became a much more expensive place for today’s working class. “ESG wasn’t the sole reason for inflation during the Biden years,” I write, “but it helped make it increasingly difficult to eradicate using normal policy tools.”

Yes, woke government and corporate wokeness is destabilizing the U.S. economy. As markets wobble, and the economy slows, we have Sleepy Joe and babbling Kamala talking about Supreme Court reform—and the media-industrial complex allows possibly the next president not to answer a single serious policy question in the weeks after she replaced her old boss at the top of the ticket because to do so might elect Donald Trump.

Corporate America is now finally retreating from wokeness because consumers hate it when they are forced fed progressive cultural change, like watching a transwoman sip their favorite beer in a bubble bath. If that weren’t the case, Bud Light would still be the nation’s stop selling brew. If people like woke capitalism, Larry Fink, the CEO of BlackRock and once king of ESG, would still be singing its praises instead of vowing never to use the acronym again.

If wokeness sold, Jamie Dimon wouldn’t be backpedaling from his own brush with wokeness. The JP Morgan chief went full-on-woke after George Floyd’s tragic death—public statements decrying systemic racism and new lending programs as if a cheap mortgage would have stopped George Floyd from trying to buy cigarettes using a counterfeit $20 bill and resisting arrest that afternoon in Minneapolis. Dimon was even spotted in a photo visiting a bank branch and taking a knee during the 2020 summer of love in apparent solidarity with the social justice and Black Lives Matter protest movement that followed Floyd’s killing.

I inquired about Dimon’s posture. Was he channeling his inner BLM? His flack had no problem tacitly confirming Dimon’s virtue signaling at the time. As I report in my book, that has suddenly changed. Now that BLM’s shaky finance, warped, leftist and at times violent ideology has been thoroughly exposed, Dimon’s handlers assure me he was taking a knee—but only to fit in the photo. It took them four years, and possibly the repulsive actions of BLM’s Chicago chapter—a social-media post of a paraglider with the Palestinian flag celebrating the monsters who committed the October 7 massacre near Gaza—for them to come up with that.

Kamala Harris promises more of the same, and it’s one big reason the markets are crashing.

Charles Gasparino is a FOX Business Senior Correspondent and New York Post columnist. Follow: @CGasparino.

COMMENTS

Please let us know if you're having issues with commenting.