It’s Juneteenth. You MUST Celebrate.

Happy Juneteenth to those who celebrate, which is everyone on Wall Street, apparently. Markets were closed today, but we wanted to give you a Breitbart Business Digest anyway.

Juneteenth, which is also known as “Emancipation Day,” commemorates the day in 1865 when Union soldiers informed black Americans in Galveston, Texas, that they had been freed. Of course, the Emancipation Proclamation was signed nearly two-and-a-half years before, which adds some awkwardness to the occasion; perhaps that’s why the holiday wasn’t officially adopted until recently.

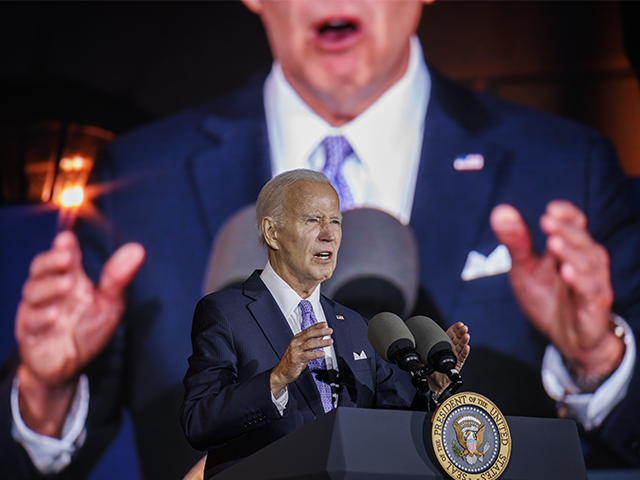

After 50 years in public life and with a checkered history when it comes to race relations, Joe Biden suddenly declared we “must” observe the holiday as of last year. He is, if nothing else, a political animal.

President Joe Biden, joined by Vice President Kamala Harris, lawmakers, and guests, signs the Juneteenth National Independence Day Act Bill on June 17, 2021, in White House. (Official White House Photo by Carlos Fyfe via Flickr)

So, here we are. Government employees get the day off while many of us in the private sector go to work and earn tax revenue to fund their free time.

Terrific.

What’s more, to have yet another holiday fall smack-dab in the middle of Pride month is almost too exciting to bear.

In all seriousness, while some on the left are clearly trying to use Juneteenth to supplant or undercut Independence Day, I think overall Juneteenth is a nice opportunity to remind Americans that the Republicans freed the slaves from racist Democrats. So, enjoy!

(Make sure to read my colleague Joel Pollak’s take on the day here.)

Bidenflation, Political Buzzsaw

One thing Biden World will not be celebrating today is the June Cygnal survey that found that “inflation and the economy” is the priority of American voters at this point in the election cycle. A plurality of 27.9 percent of respondents to the survey listed financial concerns as their top priority; all other possible responses to the survey trailed by considerable margins.

Making matters even worse for Joe Biden, the second-most important issue, according to the respondents, is illegal immigration, which was tops among 19.7 percent of those surveyed.

It gets even worse still for Joe and the Dems: abortion finished last in the survey (4.1 percent), just behind gun control (5.8 percent) and climate change (5.9 percent), all tent-poll platform issues for Democrat candidates.

So, while national polls paint the picture of a tight presidential race heading into the first debate next week, Joe Biden’s slate of issues are unambiguously unpopular with normal Americans.

Thus, the economy and Bidenflation could prove to be the deciding factor in this election. Will people who dislike both candidates vote against their own (perceived) financial interests? We won’t know until November, but it’s Biden and the Democrats who will have to sweat it out until then.

Home Builder Confidence Tanks

Not everyone was off Wednesday, however. The National Association of Home Builders released their monthly index that tracks the single-family housing market, and the results were quite weak. High mortgage rates are to blame, of course. Rates are hovering at around seven percent for 30-year mortgages, which is about the average over the last year-and-a-half-plus. The index fell to 43 in June, which is down from 45 in May and well below the 45.5 median forecast.

Not only does this data reflect the elevated levels of pessimism, it also will likely increase it.

Nvidia: The Magnificent One

The biggest buzzphrase in finance over the last year or two is “The Magnificent Seven,” which connotes the seven publicly traded tech behemoths (Microsoft, Apple, Nvidia, Alphabet, Amazon, Meta, and Tesla) that have essentially carried the stock market over recent years. Yet, the A.I. race has reframed the discussion, and one company has emerged as the biggest of them all: Nvidia.

The semiconductor company’s market cap was at $2.16 trillion as of April 1, having already surpassed every publicly traded company on earth aside from Apple and Microsoft. It had popped to a world-beating $3.34 trillion as of this morning.

The company was founded all the way back in the early ‘90s and was initially tailored to the video game industry by way of graphics processors. It pivoted to cryptocurrency mining chips and cloud gaming before hitting its stride in this A.I. gold rush.

The company’s dominance in A.I. chips and data centers has it in prime position to continue to rise at a rapid rate.

Whether or not the A.I. revolution brings about a new golden age, the apocalypse, or something in between, one thing is certain: people who bought Nvidia 20 months ago or more are very rich and are likely to only get richer.

COMMENTS

Please let us know if you're having issues with commenting.