Tax Day Cometh…

We made it, fam! It’s another Tax Day. For some, April 15 is a day that can fill an American citizen with pride. It shouldn’t. Your money is almost certainly getting squandered by the federal government in ways both well known and mysterious. (If you need examples, see Breitbart.com literally any day ever.)

That makes today a perfect time to remind our readers that elections matter. If you like keeping your money, the stakes are high this year.

Many of you (like the author of this edition of the Breitbart Business Digest) had to cut a massive check to the IRS today. We feel your pain. Many of you, however, are celebrating “refund season.” Yet, in this current economic climate, that doesn’t necessarily mean you’re going to be planning a trip to Bermuda any time soon. The Wall Street Journal summed it up well in a recent headline: “Where Are This Year’s Tax Refunds Going? Right Into a Debt Hole. With credit-card debt at record levels, refunds are helping people make ends meet.”

The Journal also noted that you shouldn’t necessarily count on getting that refund check within 21 days, as the government advertises. Often times it can take more than a year.

Yes, debtor culture has overwhelmed the Biden economy. Even if we come into a little money, it’s probably going to be used to pay off things we’ve already bought. For many Americans, with April 15 comes the realization that it’s time to sacrifice, either by working harder, tightening the belt, or, apparently, accumulating more debt. When the going gets tough, the tough get going… and borrowing.

…And a Tax Hike Could Cometh

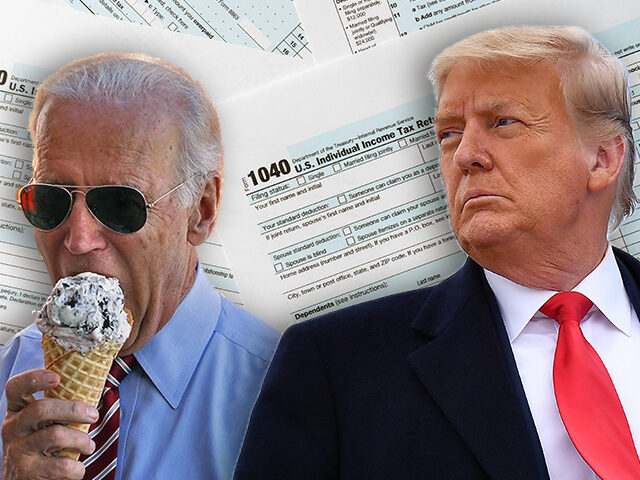

Yet, Joe Biden, who is famously financially illiterate (see my book Breaking Biden for seemingly endless details), has an ace up his sleeve: raise your taxes.

Yes, if he is reelected, that’s exactly what he’s going to do.

He won’t phrase it that way, of course. He’ll say he’s simply letting Donald Trump’s 2017 Tax Cuts and Jobs Act expire. That is a distinction without a difference. It’s a tax hike, pure and simple.

Thus, this election, we have a tale as old as time: the Democrat wants to confiscate more of what you make for the government’s pleasure, and his Republican challenger does not.

Often times politics is complicated. But on April 15, it seems quite simple.

President Donald Trump holds up the Tax Cuts and Jobs Act after singing it into law in the Oval Office on December 22, 2017. (Mike Theiler/Pool via Bloomberg

YOLO Retail Sales and Rate Cut Hopes

Retail sales data came in for March, and data was incredibly strong. In laymen’s terms: people are spending money like crazy. Post-pandemic trends continue, as more and more Americans appear to be telling themselves “you only YOLO once” before taking out their credit cards. This is even more evidence which supports our position that there is no need for the Fed to cut rates just yet.

Speaking of the Fed, home builder sentiment is no longer rising as it has become clearer that the Fed won’t cut (at least as much as previously thought) because inflation is too high.

Stock Market Shrugs Off WWIII

Stocks were down a bit today, but considering there was legitimate concern just two days ago that we were about to enter World War III, they weren’t down much. Apparently people do not believe that Iran’s drone strike on Israel over the weekend is far outside of the ordinary, at least as far as the Middle East is concerned.

COMMENTS

Please let us know if you're having issues with commenting.