President Joe Biden’s agencies are threatening banks with federal investigations if they do not grant cheap loans to risky illegal migrants.

The loans-for-migrants push is yet another effort by pro-migration lobbies to shoehorn wage-cutting, rent-spiking illegals into Americans’ fractured society. That multi-angled push benefits migrants and investors — but inflicts vast civic and economic damage to ordinary Americans.

The agency threats were posted on October 12 by Biden’s pro-migration radicals at multiple government agencies.

“This guidance reminds lenders that denying someone access to credit based solely on their actual or perceived immigrant status may [emphasis added] violate federal law,” said a statement by Kristen Clarke, Biden’s chief of the Justice Department’s civic regulation division. Her use of “may” shows she has no proof of such illegalities by the banks.

The government “will not allow companies to use immigration status as an excuse for illegal discrimination,” said Rohit Chopra, director of the semi-independent Consumer Financial Protection Bureau. However, his statement does not provide any evidence that banks are justifying illegal discrimination by treating legitimate customers as illegal immigrants.

Moreover, the Democrats’ statements admit that banks can deny loans to illegal migrants.

RELATED: A Literal WAVE on the Rio Grande: Illegal Immigrants Wade Their Way into U.S.

Corrie Boudreaux via Storyful“The Equal Credit Opportunity Act (ECOA) … [and] regulations found at 12 C.F.R. part 1002, commonly known as “Regulation B” … do not expressly prohibit consideration of immigration status,” the statement admits.

Banks have a big incentive to avoid risky loans to illegal migrants: The cost of unpaid loans will hurt their profitability and impose burdens on ordinary American clients, including the owners of small businesses.

Moreover, many illegal migrants are under pressure to pay off high-interest loans to the coyotes who pay off the cartels on their route to U.S. borders. This means the U.S. bank loans would likely be redirected to quickly pay debts to the coyotes, effectively subsidizing and supercharging the international smuggling gangs.

But law-abiding banks are also vulnerable to overt and covert retaliation if they contradict regulations’ political demands.

In this case, the agencies are threatening law-abiding banks with regulatory investigations for imagined illegal racism. Those investigations can be very painful because they can be cited by Biden’s officials as an excuse to stonewall the banks’ routine interactions with government agencies.

That vulnerability to closed-door political pressure allowed President George Bush’s regulators to make banks maximize their high-risk home loans in the early 2000s. That reckless political policy helped to create the disastrous 2008 economic crash.

In this year’s campaign, the CFPB posted a blog note describing a supposedly illegal case of not lending to one of President Barack Obama’s DACA illegals:

“On the phone, [the loan agent] mentioned how our [the consumer and their girlfriend’s] credit scores and income were very good and we should have not any issues getting a final approval [for an auto loan].” Upon learning that the consumer’s girlfriend was an immigrant with protection under DACA, however, the loan agent “immediately said we did not qualify.”

The agency posted the blog note even though multiple courts have declared the DACA program is illegal.

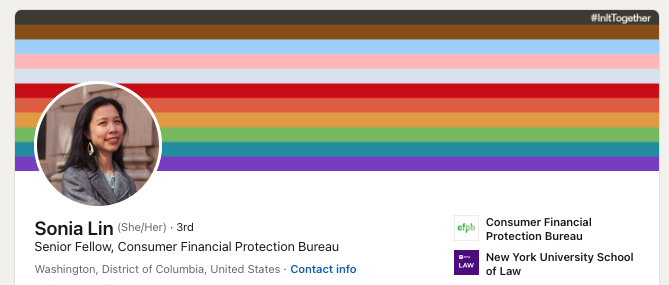

Notably, the author of the CFPB’s threatening blog note is Sonia Lin. The daughter of immigrants was hired as a “senior fellow” at the CFPB because she had worked for several pro-migrant advocacy groups.

For example, she worked at the New York City Mayor’s Office of Immigrant Affairs, which helps the city’s elite by importing subservient migrants to replace the damaged Americans who flee the city for better wages and good civic management that is found in many other cities.

On LinkedIn, Lin describes herself as “a policy leader, legal advisor, and strategic problem solver, with substantial management and supervision experience and a demonstrated record of successful advocacy on behalf of immigrant families and workers.”

In a 2022 report for the CFPB, Lin lamented that illegal “migrants who have not yet been granted legal protection in the United States may face additional challenges,” and she urged pro-migration advocacy groups to work with her.

Biden’s progressive deputies — including many adult offspring of prior immigrants — have imported roughly 4 million illegal migrants into Americans’ society.

That policy has aided wealthy investors by fueling housing inflation, curbing wages, slowing high-tech investment, reducing foreign investment, and discarding millions of Americans.

COMMENTS

Please let us know if you're having issues with commenting.