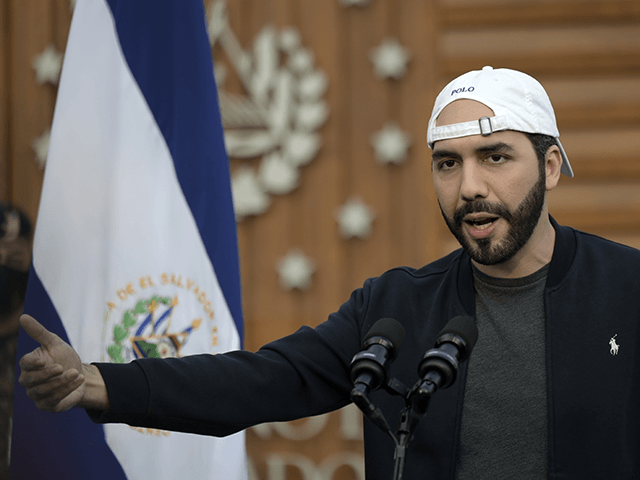

El Salvador President Nayib Bukele denounced on Wednesday an effort by U.S. senators to introduce legislation that would “mitigate potential risks to the U.S. financial system” allegedly posed by El Salvador’s adoption of the cryptocurrency Bitcoin as a legal tender.

“OK boomers … You have 0 [zero] jurisdiction on a sovereign and independent nation,” President Bukele wrote in a statement posted by his official Twitter account on February 16.

“We are not your colony, your back yard or your front yard,” he continued.

“Stay out of our internal affairs,” the Salvadoran president wrote, adding, “Don’t try to control something you can’t control.”

Bukele attached a URL to the Tweet linking to a February 16 press release by the U.S. Senate. The document revealed U.S. Senators Jim Risch (R-Idaho), Bob Menendez (D-N.J.), and Bill Cassidy (R-La.) “introduced the Accountability for Cryptocurrency in El Salvador (ACES) Act” on that day. The legislation requires a U.S. State Department report on El Salvador’s adoption of Bitcoin as legal tender “and a plan to mitigate potential risks to the U.S. financial system.”

El Salvador became the first country in the world to formally adopt Bitcoin as a legal tender in September 2021. The historic action has inspired politicians in other countries with developing or emerging economies, such as Panama and Paraguay, to propose their respective governments follow suit.

The U.S. government is concerned about El Salvador’s adoption of Bitcoin — and its potential to push other nations to formally recognize digital tokens — because cryptocurrency is decentralized, meaning it is not controlled by any state actor. The U.S. has traditionally exerted dominance over less powerful nations through financial sanctions and other economic measures. Washington’s inability to control cryptocurrency may weaken the U.S. government’s reliance on financial actions to achieve its political goals.

The “Accountability for Cryptocurrency in El Salvador (ACES) Act” proposed on February 16 refers to this threat, labeling it a “risk to the U.S. financial system.”

The U.S. financial system is based on the U.S. dollar, which is often referred to as the “world’s reserve currency.” Any economy that hopes to do meaningful business on the world’s stage must base its transactions on the U.S. dollar. Directors of the International Monetary Fund (IMF), which is heavily influenced by the U.S. government, “urged” El Salvador’s government to drop Bitcoin’s “legal tender status” during a meeting with Salvadoran government officials on January 24.