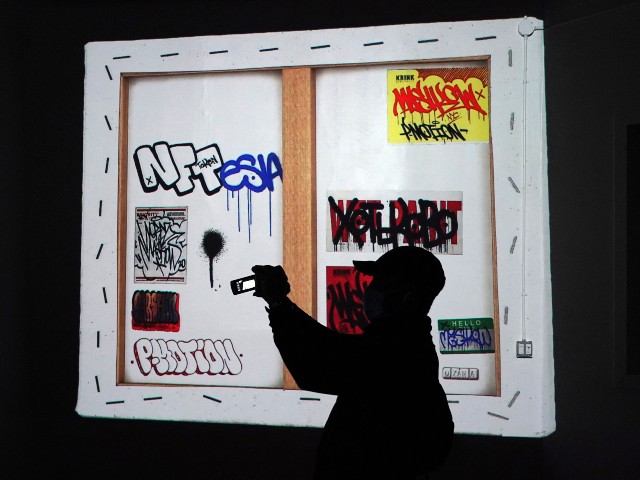

Theft of Non-Fungible Tokens (NFTs) appears to be on the rise, with many collectors losing millions of dollars as a result. In one recent example that led to widespread mockery, an NFT investor complained “all my apes are gone,” referring to the popular “Bored Apes” and “Mutant Apes” NFTs they had invested in.

Vice News reports in an article titled “‘All My Apes Gone’: NFT Theft Victims Beg for Centralized Saviors” that the theft of NFTs is on the rise and collectors are losing millions of dollars. Vice gives the examples of Chelsea art gallery owner Todd Kramer who on New Year’s Eve had 615 ETH (approximately $2.3 million) worth of NFTs stolen by scammers and listed on the NFT marketplace OpenSea.

The majority of NFTs stole were part of the Bored Apes and Mutant Apes NFT collections. Kramer took to Twitter immediately and begged for OpenSea to help him and called out to the NFT to aid him in recovering his NFT apes. Others of course immediately made fun of Kramer, telling him to change his profile picture featuring one of the Apes as he was no longer the owner of the NFT.

Many were quick to note that OpenSea intervening in the situation seemed to go against a key value of the industry, which is that “code is law” and that once your tokens are in someone else’s wallet, they own them. OpenSea could not reverse the transaction on the blockchain but it did stop the NFTs from being sold on its marketplace.

OpenSea stated: “We take theft seriously and have policies in place to meet our obligations to the community and deter theft on our platform. We do not have the power to freeze or delist NFTs that exist on these blockchains, however we do disable the ability to use OpenSea to buy or sell stolen items. We’ve prioritized building security tools and processes to combat theft on OpenSea, and we are actively expanding our efforts across customer support, trust and safety, and site integrity so we can move faster to protect and empower our users.”

Vice News writes:

OpenSea’s interventions, when they do happen, leave some users in the lurch. For example, another Twitter user recounted in a viral post how they unwittingly purchased a stolen NFT on OpenSea for 1.5 ETH (around $5000) only to have it frozen. OpenSea wasn’t quick to help them out, they said—although, it’s unclear what the company could really do at that point—and the NFT project Alien Frens reimbursed them 1 ETH.

In these and other cases, “self-sovereignty” is offered up as an attempt to reframe what actually happened. Yes, the victims are ridiculed for falling prey to a hack or scam, expected to learn from their mistake by using cold storage, and in the best scenario able to buy the NFTs back at a discount because they’re not sold on major marketplaces. But at least there was no centralized intervention. Kramer himself was able to buy at least two of his NFTs back with the help of users who had unwittingly bought them from the scammer.

OpenSea’s interventions in the cases of stolen NFTs show how centralized intermediaries often have an important role wherever the decentralized world of the blockchain meets the real world. It’s also not the first time that similar moves have happened elsewhere in crypto, even though they break from the core dogma of immutability and self-sovereignty.

Read more at Vice News here.

Lucas Nolan is a reporter for Breitbart News covering issues of free speech and online censorship. Follow him on Twitter @LucasNolan or email him at lnolan@breitbart.com

COMMENTS

Please let us know if you're having issues with commenting.