Former Vice President Joe Biden announced a new economic “task force” Wednesday that includes Stephanie Kelton, a former adviser to Sen. Bernie Sanders (I-VT) who is an advocate of the controversial “Modern Monetary Theory” (MMT).

The “task force” is one of six policy groups established by the Biden campaign and staffer by left-wing advisers.

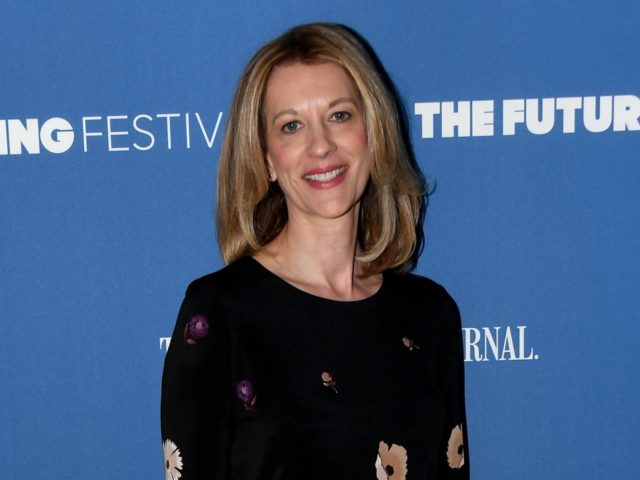

The New Yorker has described Kelton, who is also a professor of economics and public policy at Stony Brook University, as “The Economist Who Believes the Government Should Just Print More Money.”

In a profile last year, the magazine called her “the foremost evangelist of a fringe economic movement called Modern Monetary Theory, which, in part, argues that the government should pay for programs requiring big spending, such as the Green New Deal, by simply printing more money.”

Breitbart News financial editor John Carney explains:

Modern monetary theory argues that the U.S. government’s spending isn’t limited by what it taxes or borrows, although it admits that too much government spending can drive up prices by competing with the private sector for resources. Typically, MMTers think the deficit is too low to support sustained economic growth and should be higher. That means the government could spend much more and tax much less than it does today, although many of the theory’s proponents are leftists who tend to advocate for higher levels of govenment spending. MMT argues that the government should use a job guarantee at a fixed wage to stabilize the economy rather than central bank interest rate policy.

MMT entered the political debate last year, thanks in part to the big-spending proposals of “democratic socialists” like Rep. Alexandria Ocasio-Cortez (D-NY). Her “Green New Deal” proposed removing all fossil fuels from the U.S. economy by 2030, and guaranteeing everyone jobs and benefits. The cost was estimated at close to $100 trillion over a decade. Ocasio-Cortez is also advising Biden, as the co-chair of the climate change group (with former Secretary of State John Kerry).

Many critics point to the most obvious flaw in MMT: that it would simply push the federal deficit and the national debt — already skyrocketing — to further and further extremes. Only the fact that the U.S. happens to print dollars, which are still in high demand globally, prevents the economy from suffering the effects of deficits even at current heavy spending levels.

The Wall Street Journal‘s James Mackintosh wrote last year that while MMT understands some of the flaws of existing monetary policy, its chief problem is that it gives politicians too much responsibility for managing the economy.

“Put politicians in charge and the macroeconomy will be even more subject to the electoral cycle than it already is,” he wrote.

Joel B. Pollak is Senior Editor-at-Large at Breitbart News and the host of Breitbart News Sunday on Sirius XM Patriot on Sunday evenings from 7 p.m. to 10 p.m. ET (4 p.m. to 7 p.m. PT). His new book, RED NOVEMBER, is available for pre-order. He is a winner of the 2018 Robert Novak Journalism Alumni Fellowship. Follow him on Twitter at @joelpollak.

COMMENTS

Please let us know if you're having issues with commenting.