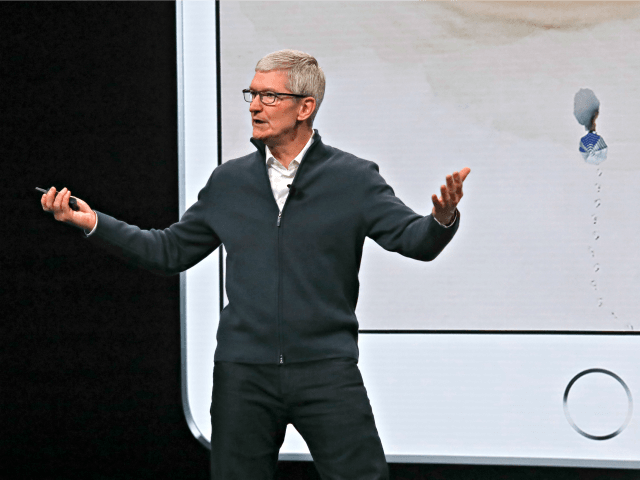

Apple shares dropped 7 percent after CEO Tim Cook lowered the company’s projected revenues for the first quarter of its 2019 fiscal year, blaming China’s slowing economy for the shortfall.

Via a letter to investors, Cook reduced Apple’s prior expected Q1 earnings from $89-92 billion to $84 billion. According to Cook, the shortfall is “over 100 percent from iPhone and it’s primarily in greater China.”

Cook pointed to China’s slowing economic growth as a cause of Apple’s lower-than-expected revenues:

While we anticipated some challenges in key emerging markets, we did not foresee the magnitude of the economic deceleration, particularly in Greater China. In fact, most of our revenue shortfall to our guidance, and over 100 percent of our year-over-year worldwide revenue decline, occurred in Greater China across iPhone, Mac and iPad.China’s economy began to slow in the second half of 2018. The government-reported GDP growth during the September quarter was the second lowest in the last 25 years. We believe the economic environment in China has been further impacted by rising trade tensions with the United States. As the climate of mounting uncertainty weighed on financial markets, the effects appeared to reach consumers as well, with traffic to our retail stores and our channel partners in China declining as the quarter progressed. And market data has shown that the contraction in Greater China’s smartphone market has been particularly sharp.Despite these challenges, we believe that our business in China has a bright future. The iOS developer community in China is among the most innovative, creative and vibrant in the world. Our products enjoy a strong following among customers, with a very high level of engagement and satisfaction. Our results in China include a new record for Services revenue, and our installed base of devices grew over the last year. We are proud to participate in the Chinese marketplace.

In a Wednesday interview with CNBC, Cook further blamed trade negotiations between America and China: “If you look at our results, our shortfall is over 100 percent from iPhone and it’s primarily in greater China. … It’s clear that the economy began to slow there in the second half and I believe the trade tensions between the United States and China put additional pressure on their economy.”

According to Chinese government figures released in October, China’s third-quarter growth figures show its economy expanded at its slowest pace since 2009.

As of this article’s publication, Apple Inc. is valued at over $749 billion, making it the most valuable publicly traded company in the world.

Follow Robert Kraychik on Twitter.

COMMENTS

Please let us know if you're having issues with commenting.