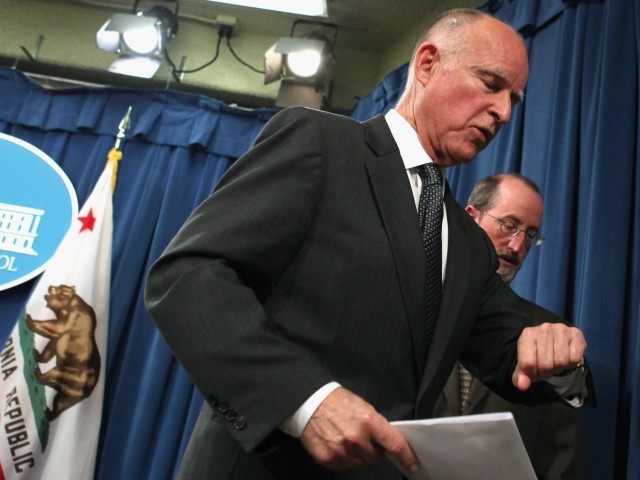

On Thursday, California Governor Jerry Brown proposed a tax in his new budget that would tax all health plans, replacing California’s current tax that only taxes health plans that participate in Medi-Cal, the state’s Medicaid plan.

California faces the threat of losing federal funding if it doesn’t comply with the Obama administration’s insistence that all health plans must be taxed, according to the Los Angeles Times.

In a statement, Gov. Brown argued that while the new tax would apply to all health plans, the overall tax burden would drop: “The package provides a net reduction in taxes paid by the private health care industry, secures funding for General Fund Medi-Cal expenses and provides an opportunity for targeted rate increases for developmental disability services.”

To pass the new tax, a supermajority will be needed in the legislature, and GOP legislators are generally opposed.

Senate Minority Leader Emeritus Bob Huff (R-San Dimas) said: “I don’t think it’s wise or prudent to start taxing the health care plans of all Californians,” noting that the state is now “flush with cash” due to surpluses.

Several versions of a health plan tax have been used in California since 2005. The current managed care organization tax levies a 3.94 percent tax on health plans that serve people receiving Medi-Cal. Because the current tax expires June 30, 2016, $1.1 billion could be lost if the tax is not replaced.

According to the Sacramento Bee, “Democrats and Republicans alike, though, have questioned the need for a revamped tax in light of predictions of higher-than-expected revenue.”

COMMENTS

Please let us know if you're having issues with commenting.