Former high school and college cheerleader Lorena Gonzalez, now a Democratic California state assemblywoman from San Diego, is on the verge of changing the state’s labor Code to protect the rights of professional cheerleaders, according to Calwatchdog.com.

On Tuesday, California’s Arts, Entertainment, Sports, Tourism & Internet Media Committee will take up her proposal, Assembly Bill 202, which stipulates that professional cheerleaders should be considered employees, not independent contractors, and thus be afforded the same protections as employees. The bill was passed by the Assembly Committee on Labor and Employment earlier in April.

Gonzalez stated, “AB202 simply demands that any professional sports team–or their chosen contractor–treat the women on the field with the same dignity and respect that we treat the guy selling beer. NFL teams and their billionaire owners have used professional cheerleaders as part of the game day experience for decades. They have capitalized on their talents without providing even the most basic workplace protections like a minimum wage.”

The California Employment Lawyers Association, California Labor Federation, and Consumer Attorneys of California all support AB202, which is the latest salvo in an attempt to change the legal status of professional cheerleaders.

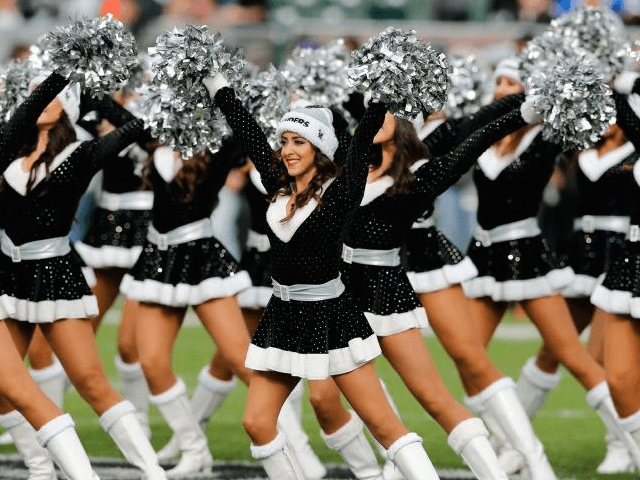

Cheerleaders for the Buffalo Bills, Oakland Raiders, Cincinnati Bengals, Tampa Bay Buccaneers, and New York Jets have all filed lawsuits against their teams.

The federal government is only too happy to classify cheerleaders as employees to gain more money. A 2006 study by the United States Government Accountability Office stated, “misclassification of workers as independent contractors…cost the United States government $2.72 billion in revenue from Social Security, unemployment and income taxes in 2006 alone.”

The state favors the proposal by Gonzales. An analysis of AB202 by the chair of the Assembly Committee on Labor and Unemployment stated, “When companies misclassify workers as independent contractors instead of as employees, these workers do not receive worker protections, including minimum wages, overtime pay, and health and vacation benefits, to which they would otherwise be entitled. Because employers do not pay unemployment taxes for independent contractors, workers who are misclassified cannot obtain unemployment benefits if they lose their jobs.”

The Internal Revenue Service states, “You are not an independent contractor if you perform services that can be controlled by an employer–what will be done and how it will be done.”

COMMENTS

Please let us know if you're having issues with commenting.