Moody’s Investor Service estimated the pension liability of all 50 states for fiscal 2011 and found Illinois had the highest total obligation as well as the highest as a percentage of the state’s annual revenues.

According to a new report, Illinois’ total pension liability for fiscal 2011 was just shy of $133 billion. This is slightly more than California which Moody’s calculates as having a $120 billion obligation. Of course California has roughly three times the population of Illinois.

The Illinois Policy Institute notes that Moody’s estimate is significantly higher than Illinois’ official estimate of $81.3 billion for the same year. The difference is the result of Illinois using “overly optimistic assumptions in calculating their unfunded liability, including an expected 8% yearly average investment return.” Using more realistic assumptions, Moody’s comes up with $133 billion.

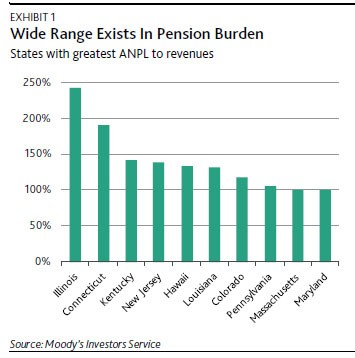

The numbers look even worse as a percentage of the state’s annual revenue. Using this metric, Illinois’ adjusted net pension liabilities (ANPL) is 241.1 percent of annual revenue. The next closest state is Connecticut at 189.7 percent. The mean for all 50 states was 60.6 percent.

Moody’s report also offers some explanation of the high pension burdens found in some states. First, they tend to be the result of “management decisions not to fund contributions at levels reflecting actuarial guidelines.” Several of the top states have taken “pension holidays” in order to meet other obligations. In addition, Moody’s found the worst offenders tend to be those states which “directly cover the cost of local school teacher pensions.”

The Illinois Policy Institute notes that FY 2012 numbers are likely to be much worse. Using realistic market assumptions (like those used by Moody’s) the liability will likely jump to $200 billion. What’s worse, neither of the plans being proposed to address the problem in the state capitol come anywhere close to addressing it.

COMMENTS

Please let us know if you're having issues with commenting.