Breitbart Business Digest: How Trump Should Fight Back Against Harris on Tariffs

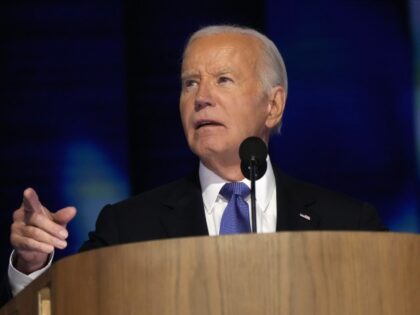

Donald Trump will have a powerful tool at his disposal in his debate with Kamala Harris this week: the lamp of experience.

Donald Trump will have a powerful tool at his disposal in his debate with Kamala Harris this week: the lamp of experience.

If you squint at the latest jobs report, you might find something to cheer about. But if you look at it with clear eyes, what you really see is an economy downshifting and bracing for impact.

The recovery in jobs from the dismal July figure was weaker than expected.

We have arrived on the eve of the most important jobs report in years.

The former president will call for cuts to regulations standing in the way of cheaper energy and housing.

Payroll processing company ADP estimates that hiring slowed significantly in August.

To watch Dollar Tree’s stock plunge is to watch, in real time, the unraveling of the economic mythology which Biden and Harris have been preaching for the past four years.

The inversion did not lead to a recession. But sometimes it is the un-inversion that is the true warning sign.

The latest sign of weakening demand for workers

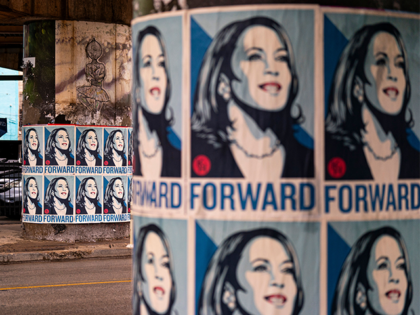

In an attempt to convince voters that a Harris-Walz administration will be more friendly to businesses than the Biden-Harris administration, Kamala Harris is proposing a tax break long supported by Republicans and rejected by Democrats.

The wheels on the U.S. manufacturing sector are not going around and around. They appear to be coming off altogether.

The Institute for Supply Management’s latest survey shows manufacturing slumped for the 8th straight month in August.

A warning for Republicans not to be complacent about the Biden-Harris economy.

Kamala Harris appears to have realized that she cannot shrug off the albatross of the Biden-Harris administration’s economic and must instead defend it.

Prices are still rising but at a much more comfortable pace.

Harris wants credit for creating jobs that came back when lockdowns were lifted.

Harris repeated one of Joe Biden most consistent falsehoods: the idea that Trump’s mismanagement of the pandemic had left the economy to ruins in 2021.

If someone were inventing a curse to fit our immediate economic era, they might put it this way: “May you live in an age of interesting revisions.”

A growing trade deficit usually means the budget deficit will grow also as government payments are needed to fill the hole in the economy created by unbalanced imports.

Consumer spending was stronger than thought but business investment weaker.

There’s an electorally powerful coalition for American first economic policies from border security and deportation, to tariffs and trade, to energy abundance and independence.

The federal funds futures market is pricing in a cut in each of the remaining three meetings of the Federal Open Market Committee this year.

Running on “joy” might not be a winning formula for Democrats in a political environment in which inflation is still the most pressing issue facing voters.

Unexpected weakness in a key economic bellwether.

Cutting rates too quickly could lead to a resurgence of inflation, forcing the Fed into a tighter monetary policy stance down the road.

Powell says Fed needs to cut to prevent further weakening of the labor market.

Tariffs tend to be paid for by exporters and importers, not consumers.

This week’s shockingly large downward revision of jobs suggests that the Biden-Harris economy’s job record is not benefiting Americans as much as it appeared to be because a huge number of the jobs are going to illegal border crossing migrants.

Because she heard them first from Trump.

Despite Kamala Harris’s claims, manufacturing employment is shrinking, and the manufacturing sector has been contracting.

The revision undercuts claims by Kamala Harris that the Biden administration’s policies have created a very strong jobs market.

The Biden-Harris administration’s claim to be building prosperity “from the bottom up” is belied by the lagged and building wage effects of their open borders policy.

Harris and Biden keep making the same misleading and false claims about the state of American manufacturing.

Customers are waiting for a downturn in interest rates, the CEO of Lowe’s said.

It is not just Kamala Harris who is looking for a better job.

Spend and tax. Tax and spend. Tax. Tax. Spend. Spend.

The economy is slowing but there index of leading indicators still says there is no recession on the horizon.

The Biden-Harris administration has controlled the White House for nearly four years, and voters are unlikely to forget Kamala Harris’s role as the chief cheerleader for Biden’s widely disliked economic policies.

Everyone’s view of current economic conditions got worse in August but Democrat hopes lifted expectations.

Homebuilding contracted violently in July.