Elizabeth Warren: ‘Student Debt Is A Gender Justice Issue’

Senator Warren (D-Mass) called on President Joe Biden to “act” on canceling student debt.

Senator Warren (D-Mass) called on President Joe Biden to “act” on canceling student debt.

BlackRock head Larry Fink said in a letter to shareholders that Russia’s invasion of Ukraine has put an end to globalization as it has been known for decades. “The Russian invasion of Ukraine has put an end to the globalization

This was the first decline in capital goods spending in a year, raising fears that the economy might be slowing more than expected.

Your suspicion that Wall Street might not have your best interest in mind has some scientific validity, according to a new study.

Mortgage rates and high prices held back sales in February.

The market appeared to register a no-confidence vote on the Federal Reserve’s inflation-fighting.

Demand destruction will be the only thing that can contain oil prices, a study from Dallas Fed economists says.

Prices charged by manufacturers in the Fifth District rose by a seasonally adjusted 9.16 percent over the past twelve months.

Federal Reserve Chairman Jerome Powell apparently figured out that the market had not quite got the message that he intends to be tough on inflation.

Growth slowed in February, with a sharp downtick in the contribution of personal consumption and housing.

Sarah Bloom Raskin took a bet that America was ready for climate regulation through bank supervision.

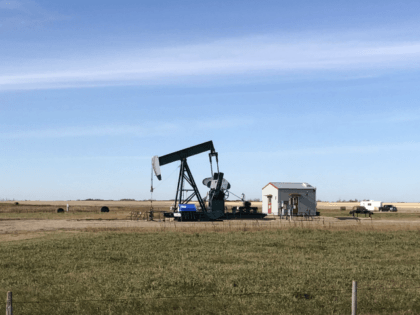

The U.S. rig count remained frozen in place and the Canadian rig count fell.

Yields on longer-term bonds fell below shorter-term ones.

Home prices are surging even while mortgage rates are climbing, creating an affordability crunch.

Harvard economist Gabriel Chodorow-Reich coined the phrase “immaculate disinflation” to describe Fed Chairman Jerome Powell’s persistent belief that the Fed can bring down inflation painlessly.

The usual relationship of completions to construction has been flipped on its head for nine months.

Back up above $100 for Brent and WTI.

Apart from this past November, it has been nearly a half-century since price hikes by manufacturers in the Philadelphia region were this widespread. The Federal Reserve Bank of Philadelphia said its monthly manufacturing survey’s index of prices received rose to

The wave of euphoria that washed over the stock market on Wednesday following the long-awaited rate hike should probably be taken as a warning sign.

A new record high in inflation expectations.

Fed officials think rates will have to keep climbing this year and next to bring inflation under control.

This week’s drop in the price of oil appears to be related to news that China’s economy may be slowing down due to rising coronavirus infections.

A distress signal for the U.S. economy from the New York Fed.

Prices keep surging higher.

A prolonged shutdown in China could mean higher inflation in the U.S., and that’s likely to weigh on the minds of Fed officials as they meet this week to discuss their interest rate target.

China has locked down its major tech export manufacturing hub.

However much you disapprove of the job Biden is doing on inflation, he disapproves of the job you are doing with inflation even more.

Nothing that points toward relief for record-high prices at the gas pump.

Sixty-three percent disapprove of the president’s handling of the issue of inflation.

The readings of current conditions and expectations among Democrats are the lowest of Joe Biden’s presidency.

Inflation is here to stay for the foreseeable future, and the White House would like us to believe it’s all Putin’s fault.

Prices jumped 2.5 percent in a single month!

Inflation has been running very hot for nine straight months and shows no signs of peaking.

Additional employment means more spending power. In an economy still suffering from supply constraints, that’s a recipe for higher prices.

Down more than 10 percent on news that UAE will encourage OPEC to pump more oil.

There are 1.7 jobs for every unemployed worker in America.

With Russia cut out of most of the things it could buy with euros, it may well decide to stop selling Europe natural gas.

Imports rose while exports fell, pushing the trade deficit up to $89.7 billion at the start of the year.

Multiple news outlets reported that a ban on Russian oil and natural gas is expected as soon as Tuesday.

Rising gasoline prices are also driving up expectations for broader inflation.