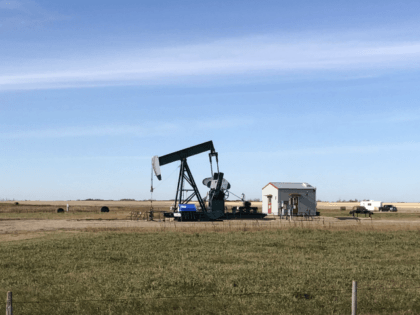

Dallas Fed Explains Why OPEC Cannot Fill The Oil Supply Gap

Some of the members of OPEC are near or already at production capacity, so even higher quotas will not add to global supply.

Some of the members of OPEC are near or already at production capacity, so even higher quotas will not add to global supply.

For the first time in the history of the N.Y. Fed’s housing surveys, a majority of renters think they’ll never buy a home.

Construction delays, high prices for materials, and rising interest rates took a bite out of single-family construction in March.

Just as Elon Musk made a weed joke with his offer to buy Twitter at $54.20 per share, Twitter’s board responded with their own weed joke.

Supply chain disruptions, high costs of materials, and rising interest rates are weighing down home builder confidence.

We are witnessing the potential destruction of globalization and the fragmentation of the global economy into competitive but somewhat isolated trading groups.

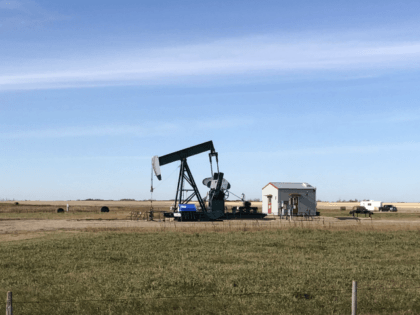

Some progress on domestic oil production.

Wholesale inventories rose as businesses expect robust demand in the months ahead.

Consumers are coping with inflation by piling debt onto their credit cards, but that debt will become more expensive when the Fed hikes interest rates to fight inflation.

Credit card debt jumped 20% higher as Americans faced the worst inflation in 40 years.

A record-high share of Americans think their personal financial condition will worsen over the coming year.

Federal Reserve Bank of St. Louis President James Bullard said Thursday that he would like to see the central bank raise its target rate to 3.5 percent by the second half of this year. “I do think we have to

The Federal Open Market Committee’s March meeting minutes indicate that the Federal Reserve still believes it can bring down inflation painlessly.

Is that a fast enough pace to defeat inflation?

The Dow Transportation Index is down by more than 20 percent from its November high.

The yield curve uninverted on Tuesday morning. The proximate cause seems to be the hawkish inflation-fighting rhetoric now coming from typically “dovish” Fed officials.

New orders and activity surged higher in March, pushing prices up at record pace.

The world’s richest man became even wealthier on Monday after he disclosed that he had acquired 9.2 percent of Twitter.

Orders for household appliances, however, rose.

The arrival of yet another blowout jobs report sent yields on U.S. government bonds rising on Friday—and inverted the yield curve again.

Still no sign of rising production.

A recession indicator was tripped for a second time in two days on Friday.

Economists had expected the economy to add 490,000 jobs and the unemployment rate to tick down to 3.7 percent.

A key market gauge of the risk of future recessions flashed a warning signal on Thursday afternoon.

Why is oil in short supply? Activists have pushed banks and investors to back away from financing oil and natural gas extraction.

It’s not just used cars and washing machines anymore.

While Democrats are accusing oil companies of price gouging, climate activists are demanding that banks stop financing fossil fuel development.

Republicans are far more trusted on inflation, jobs, and the economy than Democrats.

U.S. crude production’s expansion lagged a big jump in refinery activity, pushing up oil prices on Wednesday.

President Biden’s tax proposal would tax the gains now, leaving fewer gains to be taxed in the future.

Inflation is high because the government pumped so much money into the economy, a study from the Federal Reserve Bank of San Francisco finds.

A strong labor market and the retreat of covid-19 provided some buoyancy to consumer confidence in March, although inflation, gas prices, and the outbreak of war in Ukraine have dimmed expectations for the near-term future. The Conference Board said its

President Joe Biden’s proposed budget for the coming year uses an inflation estimate that even the White House admits is unrealistically low.

President Joe Biden’s proposed budget for the coming year includes a 4.6 percent pay hike for federal civilian employees, twice as much as the budget’s assumed inflation rate.

The Dallas Fed’s manufacturing survey show price expectations are soaring.

A new survey shows the extent of the American public’s loss of confidence in the Fed and the Biden administration’s inflation fighting skills.

No sign of relief from the Russian supply shock.

How much more of this can we possibly take?

Thirty-two percent of consumers expect their overall financial position to worsen in the year ahead, the highest ever recorded in the history of the surveys started in the mid-1940s.

Last week’s unemployment claims were at the lowest level since Richard Nixon’s first year in the White House.