Carney: Joe Biden Identifies as Fiscally Responsible

President Biden improbably wants credit for deficit reduction.

President Biden improbably wants credit for deficit reduction.

The U.S. trade deficit rose an astonishing 22 percent in March to $109.8 billion.

Fifty-seven percent of the economists, strategists, and fund managers in a recent CNBC poll say they expect the Fed’s interest rate hikes to result in a recession.

A big jump in factory orders likely reflects prices rising more than real growth.

The recession is expected to start in the second half of 2023.

The unauthorized leak of a draft Supreme Court opinion that would overturn Roe v. Wade may have violated the U.S. criminal code.

A record number of Americans quit jobs in March, especially in hotels, bars, restaurants, construction, and manufacturing.

What if the problem is not just the nonexistence of a “free lunch” but a shortage of lunches altogether?

The global food supply is experiencing severe stress.

After adjusting for inflation, construction activity likely contracted in March.

Prices paid for factory inputs rose substantially in April and at the fastest rate so far this year, the S&P Global U.S. Manufacturing purchasing managers index survey showed.

If we had not already quoted old Tom Eliot on the alleged cruelty of April, we would certainly be tempted to do so again after Friday brought the April sell-off to such a crescendo.

A brutal end to the worst month in decades.

Crop prices were up 5.6 percent from last month and 23 percent from the previous year. Livestock prices increased 6.7 percent from February and were up 39 percent compared with a year ago.

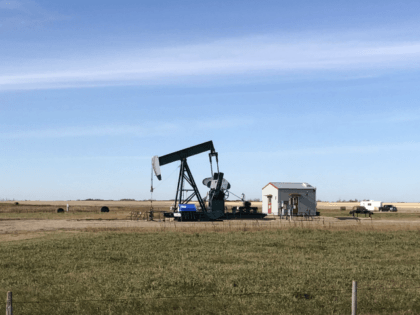

The United States added just three oil rigs this week despite crude oil prices soaring. The total number of oil rigs in the U.S. ticked up from 549 to 552, data from the oil and gas services company Baker-Hughes showed

Real personal income has fallen in 7 out of the last 8 months.

A decline in gasoline prices helped boost expectations.

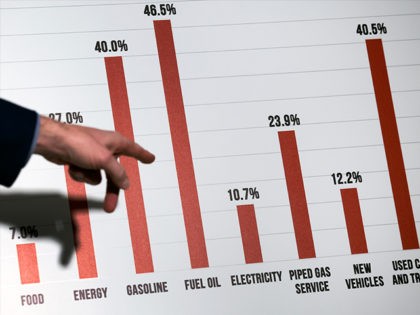

Bidenflation pushes prices up at the fastest pace since 1981.

The experts have been telling us for months that the economy was doing extraordinarily well once you look past the little problem of inflation. The American people weren’t buying it. And today’s Bureau of Economic Analysis revealed that the people were right.

A disaster start to Joe Biden’s second year in office.

Far worse than expected.

Norse mythology has a colorful warning about the danger of distraction derailing an important project. This story was brought to mind by the dramatic sell-off on Tuesday of shares of Tesla.

Concern over inflation is at its highest level since 1984.

Hwang allegedly defrauded leading global investment banks and brokerages of billions of dollars by telling them lies so his private investment firm could grow its portfolio from $10 billion to $160 billion.

After a record high in February, economists through the trade deficit in goods would shrink. Instead, it rose to a new record high in March.

We are getting a clearer picture of why the board of Twitter agreed to the takeover offer of $54.20 a share from Elon Musk.

The merger agreement between Elon Musk and Twitter has a very unusual provision. It specifically preserves Musk’s right to tweet about the deal.

High cost inflation may be triggering demand destruction, squeezing business margins as new orders slow.

Views of the current situation grew less positive while the outlook failed to recover from last month’s hope crash.

Twitter accepted billionaire Elon Musk’s $44 billion buyout offer, the company announced on Monday.

Lockdowns in China are expected to decrease demand for commodities such as oil.

For the stock market, April has indeed been the cruelest month in part because it has seen a blossoming awareness that inflation is not going to die of exhaustion after hitting 40-year highs.

Happy Earth Day!

Inflationary pressures soared in April for both manufacturers and services sector businesses, hurting business confidence and the willingness of consumers to spend.

If you want to know why the supply of oil is responding so sluggishly to demand, direct your attention to the explosive popularity of environmental, social, and governance (ESG) investing.

Pricing pressures just keep going up and up and up even as demand shows signs of slowing.

The notion that the March Consumer Price Index marked peak inflation was dealt a sharp blow by the Federal Reserve’s Beige Book on Wednesday.

Forget the idea that inflation has already peaked.

Sales of million dollar plus homes are up 25 percent while sales of less pricey homes are down sharply.

In short order we will start to see the effects of China’s COVID “static management” lockdown in global supply chains and the supply of goods in the United States.