Rig Count Relief! 13 Rigs Added as Oil Hangs Above $110 and Gas Prices Hit Record Highs

Texas to the rescue!

Texas to the rescue!

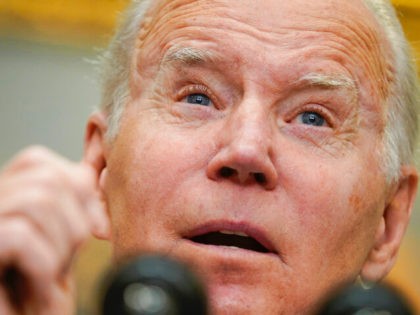

Two-thirds of Americans disapprove of President Joe Biden’s handling of the economy. Just 37 percent of Democrats say Biden’s policies are helping the economy.

The S&P 500 briefly tumbled into bear market territory.

Those who can still laugh are saying the stock market has turned their 401(k) into a 301(k).

Another casualty of the Biden era: housing affordability.

The survey confirms that the slowdown in the manufacturing sector indicated this week in the New York Fed’s Empire State survey is widespread.

The theory of greedflation was tossed into the dustbin of history by the quarterly reports of Walmart and Target.

The second big retailer to report that its earnings are getting trampled by Bidenflation and the ESG energy crisis.

Big downward revisions to prior months show inflation and higher rates had slowed the market earlier than thought.

Walmart might not have lost money on every sale in the first quarter of 2022, but it came much too close to that result for comfort.

Sales were up but profits plunged and the company cut its guidance for the year as inflation and supply chain disruptions continue.

The worst reading since the depth of the early days of the pandemic and lockdowns.

The infamous Twitter Fail Whale came to mind today when shares of Twitter fell below where they had closed on the day before Elon Musk announced his acquisition of a big stake in the company.

McDonald’s said it plans to start removing golden arches and other symbols and signs with the company’s name.

The Empire State manufacturing survey unexpectedly lurched into negative territory.

The Chinese tactician Sun Tzu wrote in his famous Art of War that a general who advances without coveting fame and retreats without fearing disgrace is the “jewel” of the kingdom.

The potential liability for getting the spam or fake account calculation wrong is enormous.

The steeper than expected decline in consumer sentiment was caused by a drop in assessments of current conditions and an even sharper decline in hope for the future.

The bad news is that Thursday’s April producer price inflation figures showed that inflation had not cooled by as much as expected.

Transporting goods across the U.S. keeps getting more and more expensive with each passing month. Pete Buttigieg call your office!

Prices charged by U.S. businesses for goods and services sold to households, businesses, and governments are up more than expected.

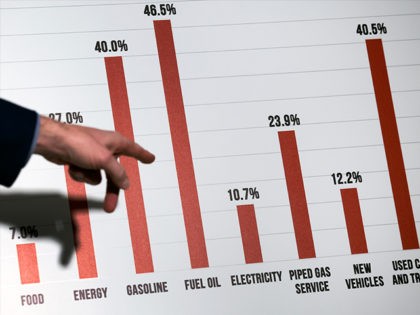

The idea that we might be headed toward a “softish landing” was probably the great victim of the April report on the Consumer Price Index.

Prices are up for air travel, car rentals, hotels, motels, swimwear, and even bicycles. And gasoline prices are going to make a road trip very expensive.

Eye-popping increases for everything from food kids eat to the clothes they wear to the shoes on their feet.

Food inflation got even worse in April. Even the kitchen table itself costs 14.9 percent more than a year ago.

Prices still rising by more than expected and after-inflation wages are falling.

There is likely to be a lot of discussion around the idea that March was “peak inflation” if the Consumer Price Index for April comes in as expected on Wednesday.

“Given where inflation is now, I suspect we’re going to have to move above neutral, but I can’t tell you exactly how far above neutral,” said Loretta Mester.

Inflation and recession worries are holding back small businesses in the U.S.

The one hundred and forty-eighth running of the Kentucky Derby produced an excellent reminder that markets do not always get everything right.

Anxiety among lower-income households has soared thanks to inflation.

Public expectations of household spending rose to a record high in April, data from the Federal Reserve Bank of New York showed Monday. The New York Fed said that households expect their spending to rise by 8 percent over the

The April employment reports released Friday perfectly encapsulated the economic moment: everyone has a job and no one is happy about it because of inflation.

Domestic energy production is being held back by taxes, ESG investing, Green New Deal policy threats, and bank regulations.

Economists had expected the economy to add 400,000 jobs and the unemployment rate to come in unchanged from the prior month at 3.6 percent.

The faith of the followers of Fed Chairman Jerome Powell is fickle. Thursday’s massive stock sell-off completely erased all of Wednesday’s Powell-inspired gains and then some.

Yesterdays post-Fed rally erased.

Unit labor costs, a measure of what businesses pay to produce a unit of output, jumped 11.6 percent.

Jerome Powell still believes in immaculate disinflation—and he appears to have won the market over to his view.

The Federal Reserve on Wednesday raised its benchmark interest rate target by half a percentage point, the biggest increase since May 2000.