Fact Check: Establishment Media Say The Economy Is Awesome

Real wages are plunging, gas prices are at a record high, home affordability at a record low. You decide.

Real wages are plunging, gas prices are at a record high, home affordability at a record low. You decide.

Ninety percent of the American public say that gas prices are extremely or very important in the midterm elections.

We have to wonder if someone at the White House is thinking that if you’ve lost Cardi B, you’ve lost America.

A majority of independents and Republicans, as well as a plurality of Democrats, say the U.S. economy is in a recession.

A severe pessimism grips the U.S. economy and Americans report the highest level of dissatisfaction with their financial situation in at least half a century, poll results released Monday show.

The cracks that have started to emerge in the post-pandemic recovery grew a bit more visible in the May jobs report.

Unemployment was up for black women, Hispanic women, black teenagers, and Hispanic teenagers.

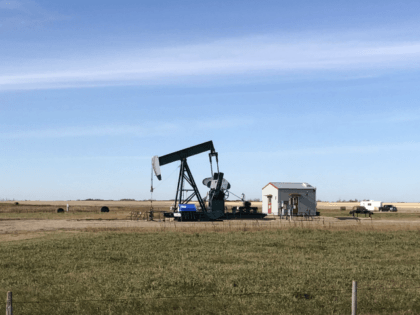

Still no help on the supply side from U.S. oil producers.

Biden misleadingly cited data from last year, when inflation was much lower, to claim Americans feel comfortable with their personal financial situation.

Economists had expected the economy to add 323,000 jobs and the unemployment rate to tick down to 3.5 percent.

The Saudis have scored a great diplomatic victory by winning a Biden visit and whatever other favors the administration has promised the kingdom in exchange for more oil. Unfortunately, none of this will help American motorists.

Businesses with fewer than 50 employees saw their payrolls drop by 91,000 in May, ADP said Thursday.

Labor costs moved much higher in the first three months of the year than previously thought.

The White House launched a campaign this week to shift the public’s perception away from the idea that inflation is the result of the Biden administration’s policies.

Recession worries are cited by three of the Fed’s 12 Districts.

The index tracking poultry prices is up 94% compared with a year ago.

We don’t know if it’s a minor one or Superstorm Sandy. You better brace yourself,” the chief of J.P. Morgan Chase said at a conference Wednesday.

The S&P Global Manufacturing PMI comes in lower than expected as inflation drags down optimism and shortages weigh on production.

It looks like Federal Reserve Chairman Jerome Powell might be the Biden administration’s next fall guy for inflation now that the corporate greed and Putin Price Hike narratives have failed to work.

Home prices are rising at a record pace.

U.S. consumers are cooling plans to buy big-ticket items or spend on summer vacations.

Another regional Fed report shows deteriorating business conditions.

Eighty-five percent of Americans have a negative view of the U.S. economy.

After seven weeks of grinding grimness, the stock market found itself in the grip of euphoria as we stumbled toward Memorial Day.

No relief in sight for soaring oil and gasoline prices as supplies dwindle.

The prices of food purchased by American households were up by 10 percent in April, the biggest jump in since 1981. The personal consumption expenditure price index for food consumed off-premises rose one percent compared with the prior month, a

Inflation has pulled down both the assessment of current conditions and expectations for what is still to come.

The government said on Thursday that the economy shrunk more in the first quarter than it initially estimated.

Pending home sales fell by more than twice what was expected.

Manufacturing activity slowed in the central U.S. while inflation pressures remained very high.

No matter which index we use to adjust for inflation, it is clear that durable goods orders actually declined in real terms in April.

April’s orders for longer-lasting manufactured goods were below expectations. This may foreshadow an even deeper slowdown for U.S. factories that appears underway in May.

The economic data out on Tuesday significantly raised the risk of a recession and moved forward the possible start of an economic slump.

What does Burry see that reminds him of 2008?

The latest evidence that U.S. factory activity is contracting in May.

A sharp slowdown in home sales can be a tell-tale sign that an economic slump is lurking ahead.

Joe Biden is discovering a political truth that no president has had to confront in decades: Americans hate inflation.

Seventy percent of Americans disapprove of Biden’s handling of inflation.

The Fed’s first hike in March did not appear to slow growth in April, raising the risk that inflation will remain high.

Donald Trump unleashed withering mockery at the news that Elon Musk will now be voting Republican.