Fed Hikes Key Interest Rate 75 Basis Points

Investors had expected a 75 basis point raise, although markets indicated an outside chance of an even larger hike.

Investors had expected a 75 basis point raise, although markets indicated an outside chance of an even larger hike.

Single-family home sales are down 19.2 percent compared with August of 2021.

The Federal Reserve is convinced that inflation expectations are extremely important. But are they right about which inflation expectations? The consensus view among Fed officials appears to be that longterm inflation expectations deserve the most attention. When Fed officials look

The economy is very close to a third straight quarter of contraction.

A big jump in multifamily construction boosted starts in August.

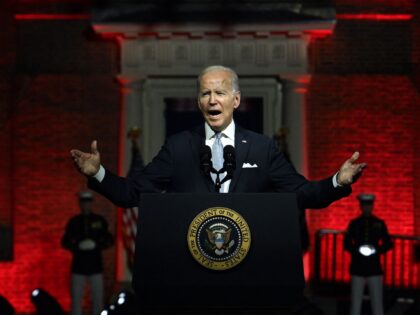

President Joe Biden keeps trying to talk America out of worrying about inflation, but it is not working. One of the reasons Biden has been so ineffective is that he has repeatedly made statement that conflict with the reality Americans

Home prices are likely to keep declining as interest rates climb higher.

Just for appearance’s sake, you would have thought that one of the homeowners in Martha’s Vineyard would have offered to open his or her house to the migrants shanghaied to the island by Florida governor Rick DeSantis.

The highest level of uncertainty about price levels since 1982.

“Macroeconomic weakness” will drag down profits and revenue, the company said.

Let’s send everyone crossing the border to the Cape Cod paradise where Barack Obama owns a 29-acre estate.

Signs that inflation is weighing on consumer demand.

Joe Biden’s policies and Fed chair Jerome Powell’s shortsightedness caused the inflation that is wrecking the standard of living of American workers.

The pageant that played out on the law of the White House on Tuesday may be destined to be the emblematic scene of Joe Biden’s presidency.

Core PPI accelerated in August. The prices of raw materials sold business to business jumped 5.7 percent.

the Biden administration and its cheerleaders in the establishment media have consistently treated inflation as an aberration that was likely to fade real soon now.

Median and trimmed mean CPI came in much hotter in August.

In reality, inflation unexpectedly accelerated in August to show prices rising once again.

Economists had thought inflation would be reversing in August.

Republicans have noticed that many U.S. businesses are hostile not only to their values but also to Republicans and conservatives themselves.

The plan transfers the burden of the debt from borrowers to taxpayers.

Although it may be somewhat counterintuitive, the prices of oil and food are likely to influence each other in the opposite way than the establishment media assumes.

A prolonged expansion, mostly due to a more resilient consumer and labor market, will mean a more aggressive Fed and a bigger rise in unemployment next year.

Amid many signs that the U.S. economy may not have contracted as much as expected given the fevered rate of Fed rate hikes, U.S. wholesale inventories continued to expand in July but at a slower pace. That could indicate cooling

Just how unbalanced is the labor market? Federal Reserve Chairman Jerome Powell sees it as extremely unbalanced, with demand for workers far outstripping supply.

The Fed chairman’s responses to a Cato Institute Q&A appeared to confirm that the Fed is planning a jumbo 75 basis point rate hike this month.

Fed officials are likely to increase their interest rate target by three-quarters of a percentage point at their policy meeting this month.

The Federal Reserve’s beige book described the economy as “unchanged” from July, indicating little growth in some regions and a shrinking economy in others.

The company said consumers have pulled back from spending more than it expected.

A strong dollar and weakening demand for imports sent the trade deficit tumbling in July.

Do you believe that business activity in the U.S. services sector contracted or expanded in August?

Did the services sector expand or contract in August? It depends on whether you believe the Institute for Supply Management or S&P Global Market Intelligence.

The morning after President Joe Biden delivered his Dark Brandon at the Gates of Hell speech, the Labor Department delivered a jobs report that was pretty close to perfect.

Business investment likely fell in real terms in July.

Economists had expected the economy to add 298,000 jobs and the unemployment rate to hold steady at 3.5 percent.

Many Americans assumed no-money-down mortgages were a thing of the past after the 2008 financial crisis. But Bank of America has brought them back in a new home loan program for some black and hispanic borrowers.

In inflation adjusted terms, single-family home construction spending is probably down by twenty percent or more.

Dueling surveys paint different pictures of demand and production.

It appears that Jerome Powell’s speech in Jackson Hole finally convinced investors that they could not fight the Fed.

ADP is no longer trying to forecast the official jobs report and says its report is an independent look a the labor market.