4 Out of 5 Americans Say We’re In A Recession Or Will Be Within A Year

The majority of Americans say their personal financial situation is getting worse.

The majority of Americans say their personal financial situation is getting worse.

Bank of America says political backlash and a looming recession likely pushed investors out of ESG equity funds.

One of the key gauges of the U.S. business cycle is once again ringing the alarm about an upcoming recession.

Climbing mortgages rates in March held back sales.

Initial claims climbed by 5,000 to a seasonally adjusted 245,000, the Labor Department said.

The eighth straight month in negative territory.

The debate over the debt ceiling is heating up again thanks to House Speaker Kevin McCarthy’s speech this week at the New York Stock Exchange.

Growth stalled but there were no districts reporting contractions of overall activity.

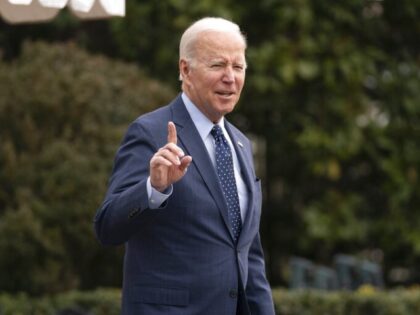

Public approval of the Biden administration’s economic policies remains extremely low, and approval of the Big Guy himself keeps falling.

Biden’s job approval rating is sinking fast as pessimism about the economy grows.

The nascent recovery in the U.S. housing market took a breather in March.

The today’s economic data is hard to square with the idea that the economy is on the brink of a recession.

A huge and unexpected surge in factory orders for New York manufacturers.

The bank panic now appears to have been transitory.

No material change in the overall assessment of economic conditions.

But unseasonably cold weather in March boosted utilities, raising overall industrial output.

Excluding auto dealers and gas stations, sales declined by less than expected in March.

Now we know why Federal Reserve officials at the March meeting yanked down their expectations for economic growth for this year and next: the economics staff of the central bank warned that a recession is on the way.

A big decline in gasoline prices in March drove the overall index down.

The number of continuing claims, however, fell in the previous week, suggesting a labor market that is still tight.

Inflation eased to the slowest pace in two years, but signals of underlying price pressures continue to indicate only minimal progress in restoring price stability.

Fed officials were advised that the central bank’s staff now sees the economy heading toward a recession.

The International Monetary Fund said on Tuesday that it expects bank lending to contract in the U.S. this year, slowing economic growth.

There was no signal in the jobs numbers on Friday that would press the Federal Reserve to back off of raising rates.

Fears of a widespread run on banks have receded.

Economists had expected the economy to add 230,000 jobs and the unemployment rate to hold steady at the 3.6 percent reported last month.

The March jobs numbers that will be reported out of the Department of Labor on Friday may be some of the most consequential of the post-pandemic era.

The first sign all year that Fed hikes may be softening demand for labor.

This is not the sort of jobs report you would expect if the economy was teetering on the edge of a recession.

Job growth was strong in both construction and hospitality.

The disastrous energy policy of the Biden administration was highlighted this week by the unexpected announcement of an oil production cut by Saudi Arabian-led OPEC+.

The number of job openings fell to 9.931 million as of the last day of February.

The Fed’s James Bullard Pushes Back Against Wall Street The Federal Reserve has begun to push the market away from the conviction that the second half of this year will see interest rates falling significantly. Federal Reserve Bank of St.

Residential construction spending fell in February and is down 9.8 percent from the peak last May.

The Bank Panic Is Not Getting Worse The banking panic appears to have receded, at least for the time being. The Federal Reserve on Thursday released its weekly balance sheet report, affectionately known as “factors affecting reserve balances” or “H.4.1”

Consumers are worried about a looming recession more than the turmoil in the banking sector.

A bit cooler than expected.

The Federal Reserve’s loans to banks expanded at a slower pace, suggesting some stability for the sector.

The market may be disappointed that Federal Reserve Chairman Powell turns out to be more Paul Volcker than Arthur Burns in staying the course in his inflation fight.

The labor market is still incredibly tight.