Breitbart Business Digest: The Yield Curve Hints That a Debt Limit Accident Is Possible

The yield curve on very short-term debt issued by the U.S. government is deeply inverted. Could this signal concerns about the debt ceiling?

The yield curve on very short-term debt issued by the U.S. government is deeply inverted. Could this signal concerns about the debt ceiling?

The index, which measures what domestic businesses are paid for goods and services, rose by 0.2 percent in April. In March, the index fell 0.5 percent.

The Department of Labor said initial jobless claims rose by 22,000 to a seasonally adjusted 264,000 last week.

The April inflation report will keep the Federal Reserve on track to pause rate hikes at its meeting next month.

Seventy-five percent of Republican voters say the debt limit should not be lifted.

Inflation has eased from its worst levels last summer but progress has been slower than expected and prices are still rising too fast.

Every unpopular Federal Reserve chairman is unpopular in his own way.

Worse than Bernanke and Yellen.

Inflation and labor market quality are the top concerns.

The president and his cabinet members have acted as if reaching a legislative compromise to the debt limit would be a violation of their principles, the Constitution, and perhaps even the divine order.

The policies of the Biden administration caused the explosion of inflation that has left so many Americans with less spending power, Freedom Works senior economist Steve Moore told Breitbart News on Monday.

Inflation in car prices accelerated to extreme levels during Joe Biden’s presidency.

The March rebound for wholesale inventories unexpected evaporated in the Commerce Department’s second estimate.

The payrolls numbers on Friday add evidence to our thesis that the economy reaccelerated in April after slowing in the prior two months.

Payrolls were expected to rise by 178,000 and unemployment to tick up to 3.6 percent.

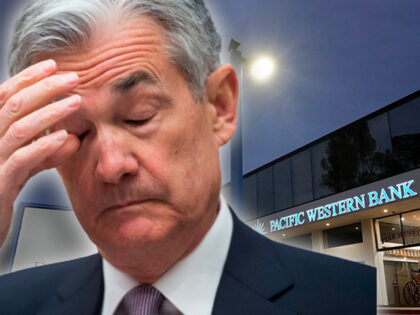

The fact that the market reacted to Fed Chair Jerome Powell’s assurances about the health of the banking sector with a rout in bank stocks raises serious questions about Powell’s credibility.

An unexpected plunge in productivity in the first quarter suggests the economy is still struggling to find its footing.

The latest crash developed within hours of Fed chair Jerome Powell saying the period of “severe stress” had come to an end.

Treasury Secretary Janet Yellen said this week that she expects the U.S. government could run out of cash as early as June 1 if the debt limit is not lifted.

Fed officials drooped language from the statement that had indicated more hikes ahead.

Payrolls at private companies grew by 296,000 in April, far more than the 143,000 expected.

Everyone has a job and no one is happy.

Job openings fell to 9.6 million in March, the Labor Department said Tuesday. That’s the lowest level of openings since April of 2021.

The economy is not losing steam at the rate many economists expected. To the contrary, we appear to be accelerating.

Another Bidenflation bank failure.

The bottom line for next week’s meeting of the Federal Open Market Committee is another 25 basis point hike.

The Fed says it will rethink its approach to regulating banks like Silicon Valley Bank.

There was nothing in the Commerce Department’s report on first-quarter gross domestic product that should give the Federal Reserve a reason to hold back on raising interest rates.

The decline suggests that demand for workers remains high despite fears of a looming recession.

The U.S. economy expanded at a sluggish 1.1 percent annual pace in the first three months of the year despite strong consumer spending. Wall Street analysts had expected a two percent increase in gross domestic product after the economy grew

April Is the Most Beautiful Month Almost everyone misunderstands why the narrator of T.S. Eliot’s “The Waste Land” supposed that April was the cruelest month. The narrator begins the poem as a depressive, deep in mourning for the collapse of

Durable goods orders soared thanks to purchases of civilian aircraft. But core capital goods orders were much weaker than expected.

The housing recession is over—for now.

Even though consumers are slightly more upbeat about the present, they are increasingly wary of the near future.

New home sales jump to 683,000, must higher than expected.

The latest evidence of an earlier than expected recovery for the housing market.

French luxury giant LVMH Moët Hennessy Louis Vuitton just became the first European company with a market value exceeding $500 billion.

“FOX News Media and Tucker Carlson have agreed to part ways,” the media company said in a statement Monday.

The Dallas Fed’s Texas Manufacturing Outlook Survey indicated that factory activity was flat in April after modestly growing in March.

It looks like we are going to have to wait a bit before we see the most-anticipated recession in living memory.