Breitbart Business Digest: Goldilocks Has Arrived in Texas

Remember, Goldilocks was sleeping soundly, with her belly full of “just right” porridge, until the bears came home.

Remember, Goldilocks was sleeping soundly, with her belly full of “just right” porridge, until the bears came home.

The data this week that has inspired such confidence that we are heading for a soft-landing should likely be interpreted as signaling that monetary policy is not yet restrictive enough.

Inflation continued to cool in June but remains above the Federal Reserve’s target. The personal consumption expenditures price index was up 0.2 percent compared with a month ago, a slight pickup in prices compared with the 0.1 percent increase in

The U.S. economy grew at a 2.4 percent annual rate in the second quarter, the Commerce Department said on Thursday.

The pace of growth of the U.S. economy picked up in the spring despite the Federal Reserve’s attempt to slow things down. Gross domestic product rose at a 2.4 percent annualized rate in the April through June period, the government said

Federal Reserve Chairman Jerome Powell said the Fed is no longer forecasting a recession given the latest economic data showing the resilience of the U.S. economy.

Sales cam in much lower than expected.

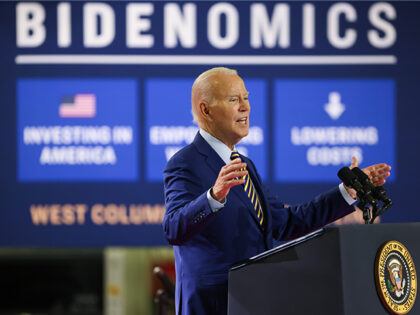

Republicans pinning their hopes for 2024 on Bidenomics being a flop should develop a backup plan.

A strong jobs market and easing inflation gave consumer confidence a bigger boost than expected in July.

Home prices are down the most on a year-over-year basis since 2012.

Maybe history will call this week’s move by the Federal Reserve the Barbenheimer Hike.

Growth is slowing in services and manufacturing remains in a slump. Inflation is proving to be a “sticky” concern.

The so-called “vibecession”—in which people feeling terrible about the economy despite very low employment—appears to be in retreat. Just ask Taylor Swift’s concert-goers.

Even the economists do not believe the Federal Reserve.

We haven’t seen a downturn in the leading indicators last this long since the run up to the Great Recession.

There just are not that many houses for sale right now.

Inflation is the number one issue and Republicans have a big lead over Democrats when it comes to bringing it down.

While the current conditions index remains mired in negative territory, the outlook brightened considerably.

The labor market remains extraordinarily resilient.

The real estate recovery hit an air pocket in June.

The poet James Russell Lowell described June as the “high tide of the year.” The June retail report showed that the tide washed something ashore for everyone last month.

The cost to taxpayers of Biden’s student loan scheme could be as high as $558 billion, according to the Penn Wharton budget model.

The headline figure missed expectations but the control group exceeded expectations.

President Joe Biden desperately wants to convince Americans that they have done well under his presidency, but that’s going to be a tough sell.

The survey was the latest piece of data supporting the idea that the economy could experience a “soft landing.”

The jobless rate rose to 21.3 percent in June, up from 20.8 percent in May. June was the third consecutive month of unemployment above 20 percent for people aged 16 to 24.

The bears got pummeled by Goldilocks this week as the latest economic data indicated a broadening of disinflationary trends.

Reports of falling inflation have given a big boost to consumer sentiment.

After the bigger loan forgiveness program was rejected by the Supreme Court, the Biden administration is looking for other ways to let borrowers off the hook for student loans.

Long and variable? Maybe not. Fed Governor Christopher Waller have a speech titled “Big Shocks Travel Fast: Why Policy Lags May Be Shorter Than You Think” on Thursday night in New York.

We still think it is unlikely that inflation will come down to two percent without a sizable increase in unemployment, but this week’s reports make the “soft landing” scenario less unlikely.

St. Louis Federal Reserve President James Bullard announced on Thursday that he was stepping down from his post to take the position of dean at Purdue University’s Mitchell E. Daniels, Jr. School of Business.

The number of Americans filing first-time claims for unemployment benefits dropped by 12,000 last week to 237,000, significantly below Wall Street’s forecast for 250,000 new claims. Jobless claims are a proxy for layoffs. Although the economy has slowed down in

The producer price index saw the smallest annual increase since 2020.

Headline inflation has slowed, but deeper long-term inflation persists.

Inflation fell by more than expected in June.

We expect President Joe Biden will take another misbegotten victory lap on inflation tomorrow.

If generals are always fighting the last war, analysts are typically buying the last rally or shorting the last downturn.

A big and unexpected tightening of credit in May.

Today’s jobs report data is likely enough to lock-in a Fed rate hike.