Breitbart Business Digest: The Bond Market Won’t Cause a Recession—But the Fed Might

The recession is back on, baby.

The recession is back on, baby.

Jobless claims came in lower than expected again and continuing claims indicate that workers who lose their jobs are quickly finding new positions.

The Commerce Department’s monthly report on factory orders is the latest evidence that U.S. manufacturing has bottomed and may even be rebounding.

A much stronger than expected report adds to the evidence that manufacturing’s slump is in the rearview mirror.

The August job vacancy data is the latest evidence that the economy accelerated in the second half of the year, defying expectations that interest rate hikes would be a drag on growth.

The White House’s attempt to sell the public on the alleged benefits of “Bidenomics” has been a flop of historic proportions.

Job openings surged above even the highest estimates, raising concerns that the Fed’s interest rates have not done enough to cool off the economy or ward off another rise in prices.

The U.S. manufacturing sector’s worst days appear to be behind it.

The Fed says that its interest rate policy is restrictive. The data on construction spending casts doubt on that.

In a small legislative body where seniority equals power and influence, Dianne Feinstein’s decades-long Senate reign warped national policy and federal spending priorities to favor her home state.

Consumers were forced to shift spending away from other goods and services because gasoline prices are soaring.

The economic challenge facing the U.S. today is not that auto workers are demand to be paid too much. It’s that inflation has destroyed too much of what they are paid.

Sales have dropped to near all-time lows.

While Senator Tim Scott declared from the Reagan Library that union demands for higher pay and shorter work weeks “will not stand,” Donald Trump told workers in Michigan that “we love being with you.”

Republicans tonight have the chance to make the GOP great again on labor issues. The question is whether they are smart enough to take up that chance.

Defense spending has surged as the U.S. tasks the makers of war machines to replenish U.S. military stockpiles depleted by support for Ukraine.

The latest Federal Reserve regional manufacturing surveys provide growing evidence that the manufacturing sector is rebounding.

The proportion of consumers saying recession is ‘somewhat’ or ‘very likely’ rose in September after dropping in August.

All three of the major indexes of home prices hit new record highs in July.

Can Republican presidential hopefuls make the case against Bidenflation in this Wednesday’s GOP primary debate?

Factory activity picked up even as businesses say they are facing stiff wage pressures and a deteriorating business climate.

The Biden administration forecast that its sanctions against Russia would be crippling. To put it mildly, this has not worked out as planned.

Manufacturing remains in contraction, although the pace of the decline has eased. Services came closer to the threshold indicating a decline in activity.

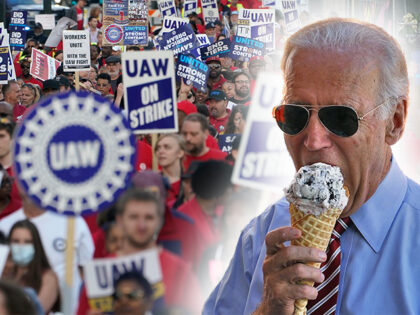

The UAW announced a big expansion to its strike, delivering a harsh blow to GM and Stellantis while sparing Ford.

By many of the most reliable leading indicators of the U.S. economy, we are long overdue for a recession. Yet the economy stubbornly refuses to cooperate.

Home affordability keeps getting worse and worse.

Jobless claims have been falling for five out of the last six weeks.

The Federal Reserve appears to expect the softest of landings next year.

Federal Reserve officials agreed to hold interest rates steady on Wednesday but indicated that they are likely to raise their benchmark target later this year. “Recent indicators suggest that economic activity has been expanding at a solid pace. Job gains

Applications for refinancing mortgages unexpectedly surged last week despite rising interest rates. The Mortgage Bankers Association (MBA) said that overall mortgage applications rose 5.4 percent last week. Purchase mortgage applications rose 2.3 percent and refinancings jumped 13.2 percent. The burst

The biggest question in economics today is whether the Fed can engineer a soft landing.

The announcement of the Federal Reserve’s interest rate target is likely to be the least interesting thing coming out of this week’s Fed meeting.

The national average for a gallon of gasoline continues to surge higher in the U.S. as oil prices keep rising.

Sentiment declined for a second consecutive month in September.

The negotiations between the United Auto Workers (UAW) and the Big Three are haunted by the specter of Bidenflation.

Higher borrowing costs have not held back industrial output as much as many economists had expected.

President Joe Biden’s attempt to jawbone Americans into being happier with the U.S. economy is not working.

The looming strike by the United Auto Workers is as much a protest against Bidenomics as it is the policies of General Motors, Ford Motor Company, and Stellantis.

Oil prices jumped on Thursday to a new ten-month high, with U.S. crude rising above $90 a barrel for the first time this year. West Texas Intermediate crude rose by more than 1.9 percent on Thursday to reach a high

Higher energy prices are fueling a sharper than expected rise in prices paid to U.S. businesses, a signal that there’s still a long way to go to tame Bidenflation.