Breitbart Business Digest: Wall Street Refuses to Take ‘No Rate Cuts’ for an Answer

Despite all of the data and the statements from Fed officials, the market has clung to the conviction that a rate cut is coming as early as March.

Despite all of the data and the statements from Fed officials, the market has clung to the conviction that a rate cut is coming as early as March.

Single family permits had a strong recovery in the immediate post-pandemic period. They fell sharply after the Fed began to signal it would raise interest rates to bring inflation down from multi-decade highs. As it became clear that higher rates

Homebuilders broke ground on new projects and made plans for future construction at a faster pace than expected in December, the latest sign that the economy ended 2023 on a footing that may be too strong to justify rate cuts

A tightening labor market could make it harder for the Federal Reserve to justify cutting rates early this year.

The American consumer’s strength may be the force that wrestles the market out of the conviction that the Fed will cut interest rates this March.

The Fed’s interest rate policy is not weighing on home building as much as it had last year.

The surge in retail sales threatens to upend predictions that the Fed could start cutting rates as early as March.

The prospects of a soft landing for the economy is no reason for the Federal Reserve to rush into rate cuts.

The business conditions index falls to the lowest level since the pandemic-stricken months of 2020.

The losses could contribute to higher budget deficits for years to come.

The financial press once again ignored the details that indicate that the era of disinflation has come to a close and risks of higher inflation are increasing.

Energy prices have been pushing down inflation. The Red Sea conflict threatens to upend that.

The case that the economy is headed for a “soft landing” received a sharp setback on Thursday with the release of data showing inflation accelerated at the end of last year.

Inflation picked up by more than expected in December as prices of energy, food, shelter, and services surged higher.

After nearly a decade of pushing back against bitcoin ETFs, the SEC reluctantly approved 10 funds on Wednesday.

The consumer inflation report this week has the potential to upset the consensus view that the Federal Reserve will start cutting rates in the first quarter of this year.

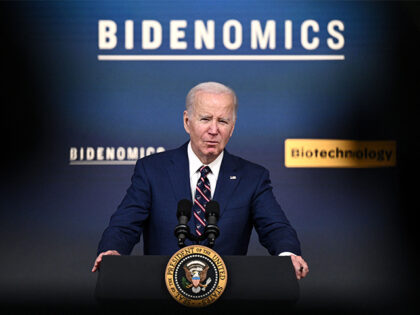

A small army of establishment media types and economists have engaged themselves in the task of unraveling what they take to be the great mysteries of our time: why the public is so unhappy with the state of the economy and why the public is not more grateful to President Joe Biden for the state of the economy.

One reason Americans may be less happy about the economy despite the very strong jobs reports that have been coming out month after month: those reports have been wrong. Each month the Department of Labor estimates the number of workers

Pick any measure of consumer sentiment you find and the reading will be the same: the Biden economy stinks.

Tracy Kasper, NAR’s president, recently received a threat to disclose a past personal, non-financial matter unless she compromised her position. Instead, she’s stepping down.

While a majority of Democrats say they are better off, only a tiny slice of Republicans and independents feel that way.

The dream of a March rate cut has survived the December jobs report.

Employers in the United States accelerated hiring in December, adding 216,000 workers to their payrolls. The unemployment rate was a very low 3.7 percent. Wages increased at a faster than expected rate.

An election year rate cut followed by a rise in inflation and then a new hiking cycle would cement the view that the Federal Reserve acted on political motives.

The ADP report said private payrolls grew by 164,000 workers last month, the biggest rise since August.

The market appears to be losing a bit of its nerve when it comes to the conviction that the Federal Reserve will aggressively cut rates this year.

The minutes note that further hikes are possibile.

The manufacturing sector continued to contract in December, a closely watched economic barometer from the Institute for Supply Management indicated on Wednesday.

The red-hot labor market that warmed the economy in recent months, showed signs of cooling in November, with employers looking to fill fewer positions, fewer workers quitting, and the number of hires falling. The number of vacant jobs fell to

The basic premise behind the conviction that the Federal Reserve will start cutting rates in the first quarter of next year is looking shakier.

The improvement in the index is the latest sign that the slowdown in economic activity in October may have been short-lived, suggesting that the economy may not have slowed as much as expected in the fourth quarter. Forecasts that the Fed is likely to start cutting rates as early in March depend, in part, on economic growth slowing.

The highest mortgage rates in 23 years were not enough to keep home prices from rising.

Could the housing market finally be cracking under the pressure of higher interest rates?

Americans are less worried about inflation and that is giving a boost to consumer sentiment. The University of Michigan’s consumer sentiment index rose to 69.7 in December, nearly 14 percent above the November reading and a few points ahead of

A key gauge of consumer inflation fell on a monthly basis in November, the first decline since April 2020. The personal consumption expenditure (PCE) price index fell 0.1 percent in November, the Commerce Department said Monday. Compared with a year

The stock market does not seem to believe we are headed for a recession next year.

While the current indicators show strength in the economy, the leading indicators point to a recession next year.

Claims remain very low, indicating ongoing strength in the labor market.

Consumer spending was revised down a bit in the third quarter.

The Federal Reserve Chairman’s silence is an implicit endorsement of the market’s view that we’re headed for five or six rate cuts next year.