Breitbart Business Digest: Biden’s Noncompete Ban Is a Gift to Silicon Valley

The Biden administration’s declaration that it will treat almost all noncompete provisions in employment agreements as illegal should be seen for what it is.

The Biden administration’s declaration that it will treat almost all noncompete provisions in employment agreements as illegal should be seen for what it is.

The big driver of General Motors’ great earnings report has been the Detroit automaker’s decision to focus on selling the gas-powered vehicles their customers want to drive instead of the electric vehicles the Green New Deal activists think they should be driving.

Money printer go brrrrrrrrrrrrrrr

The US economic upturn lost momentum at the start of the second quarter and employment contracted in the services sector, a survey from S&P Global showed.

Sales of new homes jumped 8.8 percent to a seasonally adjusted annual rate of 693,000 in March, the highest rate of sales since September of last year. Economists had expected a rate of 670,000. The numbers are reported at an

Perhaps if we started an Inflation Day movement, more attention could be drawn to the fact that rising price levels are the results of public policy choices.

President Biden signature issues are ranked low among Americans’ national concerns.

This year’s presidential and congressional elections are unlikely to be decided on the issue of tax policy, but they will very likely determine how much of the tax cuts enacted under President Donald Trump survive.

In the first three months of the year, inflation measured by the consumer price index has run at a 4.6 percent annualized rate, much higher than the 1.9 percent rate in the final three months of last year.

Someone should let President Biden know that the Federal Reserve is not going to deliver him a politically expedient rate cut.

When Biden took office, inflation was running below the Fed’s two percent target. It only took off after he pushed through his $1.9 trillion stimulus package.

Core inflation rose for a third consecutive month, the producer price index showed Thursday.

The victory over inflation that the Biden administration and many on Wall Street were eager to celebrate last year now seems to have been, well, transitory.

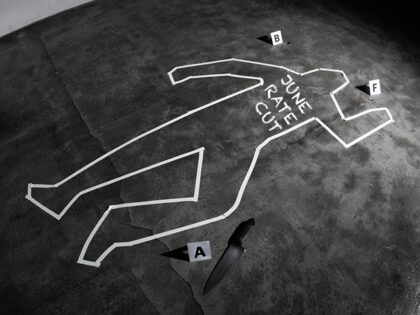

The worse than expected inflation likely dashes hopes for a rate cut in June.

There’s a specter haunting Wall Street. The specter of resurgent inflation.

Inflation is once again the top worry of small business owners.

Breitbart’s Jim Pinkerton believes there is a profitable and practical solution to the issue of carbon emissions that doesn’t involve banning gas-powered vehicles.

The dream of a June rate cut is dead.

Employment grew much more than expected for the third month in a row.

The strength of the U.S. labor market has not only defied expectations. It has given rise to the suspicions that the official figures are overstating job gains.

China and the Fed’s rate cut plans are driving up demand for gold.

In the economic seas we’re currently navigating, the idea of a Fed rate cut is starting to look like a theoretical exercise detached from the practical realities on the ground.

The Atlanta Fed said inflation is falling much more slowly than expected, so the Fed will probably not cut rates until the end of the year.

Businesses in the U.S. added 184,000 workers to their payrolls in March, the largest increase in hiring since July, according to payroll processor ADP. The March hiring exceeded even the most optimistic forecasts. The median forecast was for 155,000 jobs,

The potential that the Fed’s next move is up instead of down is arguably the most underpriced risk in the market.

Shares moved higher after the company said it was debt free and has $200 million of cash to invest in the business.

The move may hurt workers in a state that already has high inflation and the highest unemployment rate in the U.S.

The JOLTS report casts further doubt on the need for a rate cut from the Federal Reserve in the months ahead.

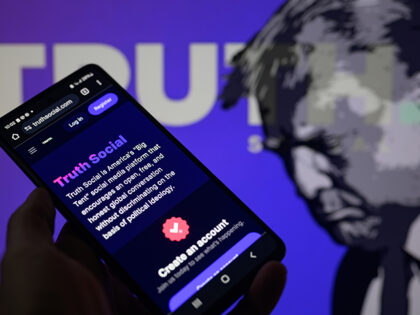

Donald Trump’s digital media company is not losing money fast enough.

The economy continues to defy expectations for a slowdown, casting doubt on the idea that the Fed will cut rates in the first half of this year.

After 16 months in contraction, the ISM manufacturing survey unexpectedly popped into positive territory.

The job of rebuilding the collapsed Francis Scott Key Bridge in Baltimore is going to take a lot longer than many people initially thought—and cost a lot more money.

The Fed targets two percent inflation.

The once and possibly future President Donald Trump’s proposal to implement a tariff of ten percent on goods imported into our Republic has been met with a cantillating chorus of critiques claiming they will come at a cruel cost to consumers.

When a bank makes a loan to Donald Trump, this does not leave less for loans to other customers.

The destruction of the Francis Scott Key Bridge in Baltimore and its economic fall out could result in the biggest-ever marine insurance payout.

An op-ed in The Hill urges the president to “show concern for rebuilding a vital bridge — and for building a bridge of inclusion for Black American workers in the construction industry as well.”

Gross domestic product, the official scorecard of the economy, grew at a 3.4 percent annualized rate in the final three months of 2023. The previous estimate had the economy growing at a 3.2 percent pace.

The grand pledge of President Joe Biden “move heaven and earth” to rebuild the Francis Scott Key Bridge smacks of a promise only Herculean in its aspiration.

Always advance.