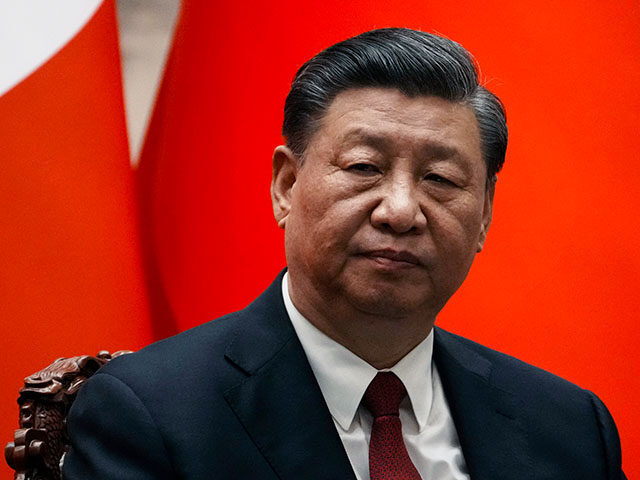

The number of high-level Chinese business executives who have vanished without warning during dictator Xi Jinping’s latest political purge keeps growing, and it has evidently made foreign investors nervous enough to hinder Xi’s efforts to lure them back after his insane coronavirus lockdowns.

The Wall Street Journal (WSJ) covered the latest disappearances Thursday:

Chen Shaojie, chief executive of livestreaming firm DouYu, has been unreachable since October, a person familiar with the matter said. The Nasdaq-listed company declined to comment on Chen’s status but said its “business operations remain normal.” Chinese tech giant Tencent owned a nearly 38% stake in DouYu as of March.

Separately, Shenzhen-listed Shandong Wohua Pharmaceutical said that its chairman, Zhao Bingxian, has been detained and asked to cooperate with an investigation. In a corporate filing dated Monday, Wohua didn’t provide details about the probe but said it wasn’t involved in the matter, and that authorities haven’t notified the firm or sought its assistance.

Neither Chen nor Zhao could be reached for comment. It couldn’t be determined what prompted Chen’s disappearance, which was first reported by a Chinese media outlet, Cover News.

The WSJ speculated that Chen might have been whisked off to secret prison because China’s Internet regulators found something they did not like during a May investigation of DoYu for allegedly streaming “pornographic and crude” material. The BBC mentioned suspicions that DoYu was involved in illegal gambling activity.

Zhao is a very big fish to disappear so abruptly – he has been dubbed “China’s Warren Buffet” for his bountiful investment portfolio. Wohua Pharmaceutical insisted it knew nothing about his detention and the investigation he is cooperating with has nothing to do with the company.

Another executive who vanished suddenly was China Renaissance Holding tech billionaire Bao Fan, a very high-profile dealmaker who abruptly went dark in February. Shares in the company plunged after its management said they could not reach Bao. The Chinese government gave no reason for his disappearance.

One of the most troubling vanishing acts was the disappearance of China Evergrande founder Hui Ka Yan, whose company’s collapse may yet trigger the implosion of the Chinese real estate market. Hui went missing after another billionaire named Wong Hongsheng accused him of becoming an “enemy of the Chinese people” by seeking bankruptcy protection for his assets in U.S. court. Hui was once considered among the richest men in China.

Several other heavyweight executives have been detained or dragged into “investigations” with public statements from the government, rather than simply vanishing into thin air. This group includes former Industrial and Commercial Bank of China president Zhang Hongli, former Bank of China chair Liu Lian’ge, and former Everbright Group chief Li Xiaopeng. The former chairman of China Life Insurance, Wang Bin, was given life in prison for corruption in September.

Chinese authorities raided a number of foreign businesses this year, arresting some of their Chinese employees. Targets included the Mintz Group, a due-diligence accounting firm, consultants Bain & Co., and risk advisory firm Kroll.

The disconcerting raids, arrests, and disappearances have stymied Xi’s effort to persuade foreign investors that China is open for business after the coronavirus pandemic, and despite growing geopolitical tensions. Xi delegated Premier Li Qiang to make friendly overtures to foreign businesses and brought exiled tech mogul Jack Ma back from Japan to convince observers that China was safe for both domestic entrepreneurs and overseas money.

“Right now, Chinese entrepreneurs are lying low or lying flat. Sentiments are weak,” Primavera Capital Group founder Fred Hu told the WSJ. “Lying flat” is a euphemism for giving less than full effort to work.

Hu said the current climate was as tense as anything he has seen since 1978 when China began opening its market to the outside world.

Variety on Tuesday noted that Chinese executives and officials are often detained by surprise and held incommunicado to prevent them from fleeing or covering their tracks, but some of the latest disappearances have dragged on for months without charges being filed or investigations announced.

DoYu has been remarkably placid about the vanishing of streaming impresario Chen, and so has the company’s biggest shareholder, internet giant Tencent. Their reticence to make waves, or even file public requests for information about the missing CEO, is all the more remarkable because streaming is an even bigger business in China than the U.S., so a lot of money is on the line if investors lose confidence in DoYu.

COMMENTS

Please let us know if you're having issues with commenting.