China’s state-run Global Times on Tuesday took a victory lap for the communist tyranny’s domination of the electric vehicle (EV) battery supply chain.

The next phase in the plan is for China to expand overseas to consolidate its grip on EVs, as with Chinese manufacturer Gotion High-tech’s recent announcement of two $2 billion battery plants in Illinois and Michigan.

Gotion will also be producing five gigawatt-hours (GWh) of batteries from its factory in Germany by the middle of 2024 and 20 GWh per year when the plant reaches full capacity. Another prominent Chinese battery manufacturer, CATL, is building a $7.8 billion plant in Hungary that will churn out 100 GWh of batteries a year when it reaches full production capacity.

CATL has a deal with Ford to build a joint EV plant in Michigan if the proposal can get past Congress, which is understandably suspicious that massive U.S. taxpayer subsidies flowing to Ford’s utterly disastrous electric vehicle division might end up in China.

The Global Times quoted “Chinese experts” who worried that American regulatory scrutiny might add unwelcome “uncertainty” to China’s global expansion plans. They also fretted that U.S. subsidies for domestic manufacturers might give them an “unfair” advantage over Chinese competitors — a hilarious complaint given the oceans of money China’s autocratic government has poured into dominating the EV, battery, and rare earth industries, not to mention China’s propensity for using slave labor to undercut the prices of its competitors.

American taxpayers are increasingly questioning why their government is forcing them to subsidize the manufacture of expensive EVs that do not sell terribly well despite the most significant government-corporate sales push in history, but Chinese communists see a tremendous opportunity to control the supply chains of that artificially created pseudo-market.

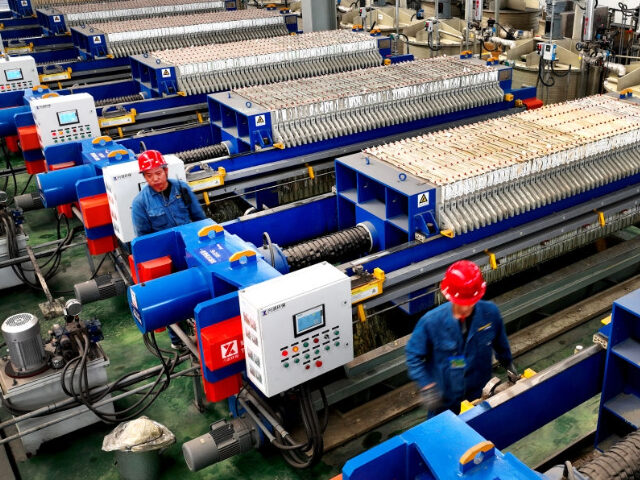

The Global Times boasted that China has “the world’s largest battery manufacturing value chain” and that its control over worldwide supply chains is nearly complete since “about 70 percent of the global battery production capacity is located in China.”

The final step for China is to intensify its efforts to acquire foreign competitors or gain leverage over them with partnerships. China’s surging battery exports will finance the takeover:

In the first three quarters, China’s exports of auto-use electric batteries totaled 89.8 GWh, up 120.4 percent year-on-year, accounting for 88.7 percent of all battery exports, according to statistics from the China Automotive Power Battery Industry Innovation Alliance, released on October 11.

“The overseas market exploration by China battery companies is accelerating, and their investment in EV plants abroad is also conducive to further improving their global EV production capacity,” Zhang Xiaorong, director of the Beijing-based Cutting-Edge Technology Research Institute, told the Global Times.

Columnist Xie Zongbo told the Global Times the United States is “a hot destination for battery and EV investment,” with opportunities for Chinese investment and control that do not exist in the “relatively complete” internal combustion engine manufacturing and supply chain. American taxpayers and their congressional representatives should ask just how “hot” they want their country to become for investment — and control — by a genocidal tyranny.

COMMENTS

Please let us know if you're having issues with commenting.