China’s trade deficit with Russia tripled in 2022, a report revealed on Friday, thanks in part to skyrocketing energy prices that made Russia’s discounted oil and gas irresistible to Chinese buyers.

China’s exports to Russia rose 13 percent to $76 billion 2022 but its imports increased by 44 percent to $114 billion, increasing the trade imbalance by over 300 percent from 2021.

This was driven by a hefty 41.4 percent increase by value in crude oil imports from Russia. Imports by volume actually declined slightly as the Chinese economy slowed under coronavirus lockdowns, but the price of even Russia’s discounted petroleum products rose sharply, so China spent considerably more money to buy a bit less oil from Russia than in 2021.

Bloomberg News noted on Friday that China “managed to avoid spiraling price rises seen in Europe and the U.S.” for energy by mining titanic amounts of coal. This stability in consumer energy prices held Chinese inflation down to two percent overall, and just under three percent for water and energy.

In this Nov. 28, 2019 file photo, smoke and steam rise from a coal processing plant in Hejin in central China’s Shanxi Province. (AP Photo/Olivia Zhang, File)

China’s National Development and Reform Commission crowed that its coal-mining binge resulted in modest energy inflation that stood in “stark contrast to the significant jumps” in American and European energy prices.

This coal-powered shield against inflation may weaken in 2023, as the Chinese economy is expected to resume growing after the end of debilitating coronavirus lockdowns, with a commensurate increase in energy demand. Energy imports would almost certainly have to increase to meet this demand, plugging China more firmly back into the volatile global market – and probably driving worldwide prices much higher as Chinese demand surges.

China is one of the few eager large-scale customers of Russian energy products after worldwide sanctions against the Russian invasion of Ukraine. China did not agree to abide by price caps on Russian oil set by the G7 and European Union in December to prevent Moscow from using oil profits to finance its Ukraine war.

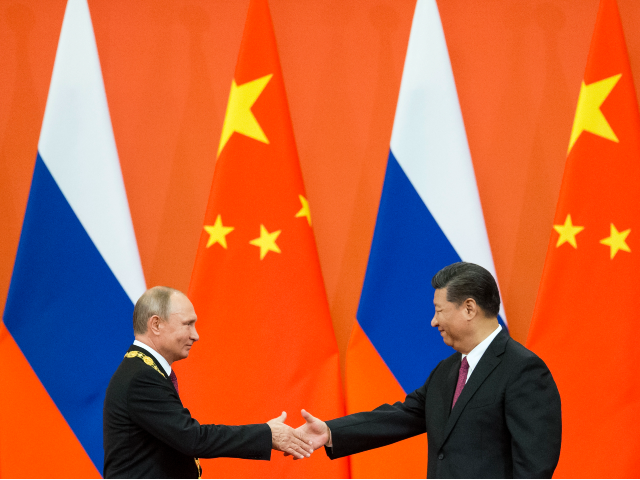

In November, Chinese dictator Xi Jinping said he wanted to “work with Russia to forge a closer energy partnership.” The Russians vowed to make more of their oil available to nations that refuse to recognize the G7/EU price caps, at the expense of customers who do.

Russia has a massive oilfield project dedicated almost entirely to supplying Asian customers with oil, especially China and India. Moscow hopes for Chinese investment in a Baltic Sea project that could provide Beijing with huge quantities of liquified natural gas (LNG) and is working on a deal with Kazakhstan and Uzbekistan to create a multi-national overland gas pipeline to China.

COMMENTS

Please let us know if you're having issues with commenting.