Last week, Donald Trump met with the family members of Sarah Root, a beautiful, beaming 21-year-old girl slaughtered by an illegal alien in Nebraska the day after graduating from college with 4.0 GPA. Later that day, Trump warned, “Crooked Hillary Clinton wants completely open borders.”

Indeed, a review of Clinton’s campaign website reveals that her immigration plan is even more radical than that of Barack Obama, who completely suspended enforcement of America’s immigration law and printed hundreds of thousands of work permits for illegal aliens.

However, a much more pressing topic seems to have triggered the passions of radio host Mark Levin who, along with Jamie Weinstein, is one of the most vocal members of the #NeverTrump movement. In the course of two days, Levin penned two lengthy denunciations of Trump’s trade platform and Breitbart News’s coverage of it.

In a story featured on this website, Levin emotionally warns conservative Americans that Trump’s effort to boost American manufacturing represents a kind of existential threat to conservatism. Levin is seemingly unconcerned with the prospect that his energetic Trump-bashing could help place Hillary Clinton in a position to add millions more Third World migrants to America, who almost certainly will not support Levin’s vision of smaller government conservatism nor tune in to his radio show where he espouses the same.

One of the enduring mysteries of the #NeverTrump movement now that their preferred vessels— John Kasich and Ted Cruz— have exited the race is why they seem to believe that Trump’s “America First” platform represents a greater threat to conservatism than Clinton’s agenda of massive government, massive taxation, and massive Third World migration.

Trump is a “radical protectionist” whose trade policy would result in “economic misery” for nearly “everyone,” Levin warns conservatives:

The billionaire is a radical protectionist who has repeatedly declared his intention to impose massive tariffs aimed at the economies of other countries, such as Japan and Mexico, and a forty-five percent tariff on products from China. Such broad tariffs would most certainly result in retaliation by the targeted countries. This is a sure job-killer that would also drive up costs of everyday products to low- and middle-class Americans. The net result: economic misery, not just for those hard-working, tax-paying Americans who work in industries that rely on international commerce and trade, but mostly everyone.”

Levin lays out his economic theory, which leads him to his conclusion: namely, Trump’s expressed willingness to protect American industries against specific countries would result in higher prices for U.S. consumers and thus ensure economic hardship. Levin writes:

Remember, a tariff is really just a tax, the cost of which is imposed on the American people. The higher the tariff, the higher the tax. Imagine what a 45 percent increase in the price of goods made, say, in Japan would do to a middle class family shopping for a Toyota or Honda. While Trump and his surrogates may have the money to pay the higher prices his policies would cause, many Americans – who are already having difficulty making ends meet – do not.

Levin makes no mention of the fact that if you raised the price of a Toyota by 45 percent, presumably Americans would not pay 45 percent more for a Toyota, but would instead buy a Ford, and that as Ford’s sales went up, the marginal cost of production would go down.

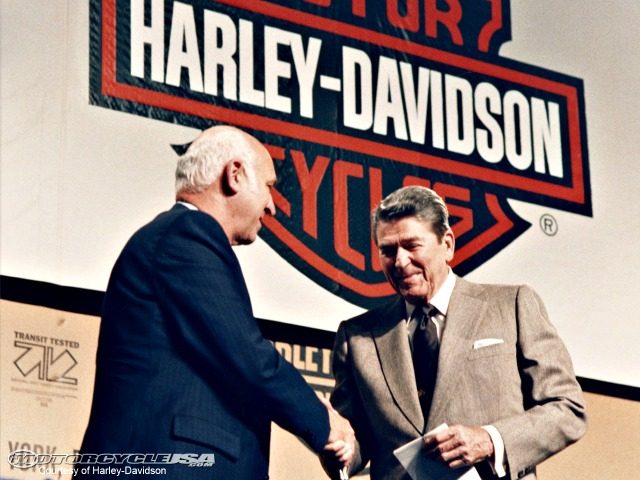

Moreover, Levin’s example (denouncing a 45% tariff on Japanese vehicles, which he imagines could be implemented by a President Trump) is completely analogous to an action Ronald Reagan took during his Presidency. As President, Reagan implemented a 45% tariff on Japanese motorcycles in order to save the Harley-Davidson Motor Company. To use Levin’s words: “Imagine what a 45 percent increase in the price of goods made, say, in Japan would do to a middle class family shopping for a…” motorcycle.

A 1984 report notes that the “average dealer net price of a Harley-Davidson motorcycle” was approximately $4,780—or “$890 more than the average dealer net price ($3,890) of Japanese-brand motorcycles in the 1000cc and over class, and $2,134 more than the average price ($2,546) of all Japanese- brand motorcycles in the 700 to 899cc class.”

Regardless, Levin attempts to defend Reagan’s actions and distinguish Reagan’s trade views from Trump’s, writing:

Reagan did not make wholesale protectionism and tariffs a central plank of his platform, as Trump does; nor did he support imposing high tariffs on every single product produced in a particular country. Actually, Reagan emphasized the opposite. Reagan’s tariffs were targeted, including on Japanese motorcycles and semiconductors, and usually in response to specific violations of trade deals. Besides, Trump is a populist/nationalist/protectionist. Reagan was a conservative. There’s a difference.”

However, Levin’s argument is self-contradictory in two ways.

First, Reagan’s actions are completely irreconcilable with the economic principles that Levin has established: specifically, Levin’s belief that an action which raises the price of imports is “a sure job-killer that would also drive up costs of everyday products to low and middle-class Americans. The net result: economic misery.”

The economic theory Levin has laid out would prohibit action to raise the price of a foreign good to protect a domestic industry— exactly what Reagan did.

Yet trade rules, by definition, are protectionist. Any prohibition on an unfair subsidy is, at bottom, a prohibition on importing a good so cheaply that an American company has no chance of competing against it. However, by Levin’s zero-sum argument that cheaper is necessarily better, none of these trade rules should exist or be enforced at all because to levy a tariff is to raise prices, and— by Levin’s argument— damage the economy.

Moreover, Reagan grounded his decisions in what Levin might define as “protectionist” rhetoric.

“The health and vitality of the U.S. semiconductor industry are essential to America’s future competitiveness,” Reagan said in 1987 as he was implementing a 100% tariff on Japanese semiconductors. “We cannot allow it to be jeopardized by unfair trading practices.”

“I have determined that import relief in this case is consistent with our national economic interest. The domestic industry is threatened by serious injury because of increased imports,” Reagan said in 1983 as he was implementing his tariff on Japanese motorcycles. “I have maintained that I would enforce our trade laws where necessary and where such actions are consistent with our international obligations.”

Reagan explained that protecting American industry is in the economic interests of the United States, even if it precludes the option of buying cheaper foreign goods. Reagan believed it was worth imposing a tariff for the purpose of ensuring that the American industry is able to survive. In other words, instead of letting the global market decide, Reagan applied a mercantilist approach saying the American producers should survive for the simple reason that they’re American— not because it’s cheaper, and not because it’s necessarily better, though it may be, but because America is better off for having it made within our own borders.

This sentiment is simply incompatible with Levin’s Cato-esque argument that the cheapest product should win the day.

The second reason Levin’s logic is self-contradictory is that Levin’s attempted exit-hatch— that Reagan was simply enforcing rules in response to specific violations of trade deals— would more than justify Trump’s proposed actions.

Trump has clearly said that if China devalues its currency, he will impose a tariff on China equivalent to the amount by which they are devaluing their currency— essentially negating the value of the illicit practice so that they stop doing it.

As Trump told the New York Times:

I would do a tax. And let me tell you what the tax should be? The tax should be 45 percent. That would be a tax that would be an equivalent to some of the kind of devaluations that they’ve done. They cannot believe that we haven’t done this yet. [Emphasis added]

Interestingly, Levin criticizes Breitbart for not including this quote in a Breitbart News report last week. However, when Levin provides the quote to his reader, for some reason, he leaves out the one sentence (underlined above) necessary for the reader to understand that Trump’s tariff is in direct response to illicit currency manipulation.

RedState—a blog that is certainly no friend to Trump—points out that members of corporate media are promoting a false characterization of Trump’s statement. RedState writes:

It seems pretty clear… that Trump is not calling for a 45% tariff specifically, he’s saying that this is basically what he figures that it would take to even out the playing field in terms of China’s devaluation of their currency… In other words, while Trump did utter the 45% figure, he seemed to be clearly using it as an example of how he would respond to a given value of Chinese currency devaluation. He did not claim it as an ironclad rule that should be used against China per se.

Reagan took a similar position in 1985 when his administration pushed the Plaza Accord, which made products from Japan more expensive by raising the value of Japan’s currency.

However, Reagan was dealing with a world in which America had a much different economic threat matrix than it does today. While economic nationalists may find fault with Reagan for not acting strongly enough to protect enough threatened industries, the scope and reach of the threats that he faced were small in comparison to today. Reagan operated before NAFTA and before China’s entrance into the WTO. Plus, for all the tensions that existed between Japan and the U.S. during Reagan’s day, Japan was never a geostrategic threat to the United States’ position in the world in the same way that China is today.

In the specific case of China, Levin complains that Trump suggested imposing a tariff across the board rather than on selected goods: “Forty-five percent [tariff] on what? Not a single product or some products. But on all products coming from China and other unspecified tariffs aimed at Japan and Mexico,” Levin writes.

Although one hardly gets the impression that Levin would drop his criticism of Trump’s proposal if Trump provided a list of the specific foreign goods he wished to subject to import duties, what Levin apparently fails to appreciate is that China’s currency manipulation would affect the price of all of their exports—not just some exports.

In other words, the only way to halt currency manipulation would be to impose a countervailing duty on all Chinese goods, which necessarily benefit from the devaluation. Trump was specific in saying that the size of his tariff would be proportional to China’s devaluation.

Though the media, as RedState points out, and Trump’s critics—including Weinstein—are perhaps willfully ignorant of this fact, Trump was explicit in saying that the 45% tariff would be a counterbalance to a 45% currency devaluation, in effect removing any incentive for China to cheat in the first place.

Trump’s tariff on currency cheating is, therefore, no more guilty of raising the price of a particular product than is NYPD raising the price of a Fossil watch when they prohibit the sale of an illegal knockoff in Times Square.

Levin’s logic is thus twisted into a pretzel. He offers a muted defense of Reagan by saying that Reagan was simply applying the rules, while at the same time, advancing an economic argument that would prohibit anyone from enforcing any trade rule at any time since such action would deny Americans access to a cheaper subsidized foreign good.

Rather than address the internal inconsistencies of his own logic, Levin’s piece primarily responds by inundating the reader with various Ronald Reagan pro-free trade quotes.

However, the thesis of a 1988 Cato analysis highlighted in Breitbart’s original report—which Levin offhandedly dismisses without explanation—seems to rebut nearly all of Levin’s op-ed. The analysis entitled “The Reagan Record on Trade: Rhetoric Vs. Reality” argues that “words are not deeds,” and an examination of Reagan’s “record leads to the question: With free traders like this, who needs protectionists?”

“Although he has made some free-trade statements, he has nearly always contradicted them with other statements and then acted like a protectionist,” wrote Cato’s Sheldon Richman, as he proceeded to level the same criticism against President Reagan for raisings the cost of goods for U.S. consumers that Levin now levels against Trump: “The Reagan policy has harmed the United States in several ways… Consumers pay more for products when quotas make imports artificially scarce and when tariffs make them artificially expensive,” Richman said.

The “free traders’” frustrations over the disparity between Reagan’s rhetoric as a trade purist and his actual trade record was echoed by others at Cato during that time.

“Despite President Ronald Reagan’s free-trade speeches, the portion of U.S. trade subject to U.S. nontariff barriers is estimated to have increased more than 50 percent since 1980,” wrote Cato’s Jim Powell in 1990.

“Reagan’s instinctive or at least rhetorical commitment to economic freedom was once again overridden, apparently for political reasons,” wrote Cato’s Daniel Klein in 1984, referring to the motorcycle tariff. “President Reagan chose to sacrifice free trade and economic prosperity to short-term political goals. Consumers may well view the higher price of motorcycles as just another form of public financing of presidential campaigns.”

Reagan’s “administration has imposed more new restraints on trade than any administration since [President] Hoover,” said William Niskanen, a former Reagan aide who later went on to work at Cato.

Richman echoed this sentiment: “Ronald Reagan by his actions has become the most protectionist president since Herbert Hoover.”

Interestingly, this again is the same criticism Levin says about Trump. While Reagan’s “free trade” contemporaries accused him of subscribing to Hooverism, Levin writes that Trump’s trade position “is not Reaganism but Herbert Hooverism.”

Levin dismisses the 1988 report by writing simply: “Hahn cites a CATO Institute piece condemning the Reagan trade record. Well, here’s a link to a CATO Institute piece praising it. So what?”

Yet the Cato piece Levin highlights—which was written in 2004 after Reagan had passed away—reads like an effort to rehabilitate Reagan’s trade record in the eyes of Libertarians in service of appropriating his name and popularity to promote their agenda—much the same way liberals use Reagan’s amnesty to suggest that Reagan would have supported Barack Obama’s amnesty. Indeed, the article, entitled “Reagan Embraced Free Trade and Immigration,” tries to argue that Reagan would have held an entirely different view on immigration than Levin does. The article even seems to take swipes at professional Reagan conservatives like Levin, writing:

Reagan’s vision of an America open to commerce and peaceful, hardworking immigrants contradicts the anti-trade and anti-immigration views espoused by [those]… who claim to speak for the conservative causes Reagan largely defined… Like President George W. Bush today, Reagan had the good sense and compassion to see illegal immigrants not as criminals but as human beings striving to build better lives through honest work… Compare Reagan’s hopeful, expansive, and inclusive view of America with the dour, crabbed, and exclusive view that characterizes certain conservatives who would claim his mantle. Their view of the world could not be more alien to the spirit of Ronald Reagan.

Groups like Cato, who at once praise Reagan’s free market philosophy whilst cheering mass migration, operate under the assumption that Reagan’s success had nothing to do with the success of the people he governed. In other words, that Reagan’s administration would have been equally successful had he been chosen president of Bangladesh.

The Cato article delineates another inconsistency in Levin’s position on trade. Specifically, Levin’s espoused economic theory dictating his trade policy seems at odds with his stated position on labor policy. Levin has previously claimed to oppose open borders, in part, because a large excess of low-skilled labor that is willing to work at a reduced salary unfairly undercuts the jobs and wages of American workers. Similarly, a large, uninhibited flow of low-priced imports manufactured by countries whose governments unfairly subsidize those goods, will undercut American manufacturing—and, subsequently, the jobs and wages of Americans who fill those jobs.

The only difference is that imports, unlike people, do not bring with them other elements such as healthcare needs, crime, different values and voting habits, welfare, education costs, and so forth. But the same economic principle applies.

Levin’s previously professed desire to curb visa dispensations seems directly at odds with his espoused economic theory that cheaper is better.

Lastly, in his op-ed, Levin takes a random swipe at famed Reagan advisor Pat Buchanan. The timing of Levin’s jab seems peculiar given that history—and this election in particular—has proven Buchanan prescient on three of the most fundamental issues concerning American voters: migration, trade, and foreign policy. In the case of the former, this is an issue conservatives could lose forever if Hillary Clinton is put in a position of power from which she can permanently dissolve America’s borders.

COMMENTS

Please let us know if you're having issues with commenting.