The DOJ claims in a recent lawsuit that Google’s 2007 acquisition of internet advertising giant DoubleClick was the beginning of the company’s alleged ad monopoly. The DoubleClick purchase started a spending spree by the Masters of the Universe that increased its stranglehold on the ads market.

Bloomberg reports that in a recent lawsuit, the government argued that Google should be broken up because it illegally monopolizes the advertising technology market. The US Department of Justice and eight states filed the lawsuit, which claims that Google’s 2007 purchase of ad-tech startup DoubleClick was the “first step in Google’s march to monopoly” and that the company now holds a monopoly position in the $626.9 billion global digital ad market.

According to the complaint, Google had difficulties launching its own ad server, which would have allowed it to place advertisements on other websites, and difficulties cultivating relationships with major advertisers before the DoubleClick deal. These problems were resolved for Google by DoubleClick, the top ad server with connections to elite publishers and major advertisers. After making the purchase, Google went on to acquire more businesses that produced tools for publishers and advertisers, getting involved in every important facet of the purchase of online advertisements.

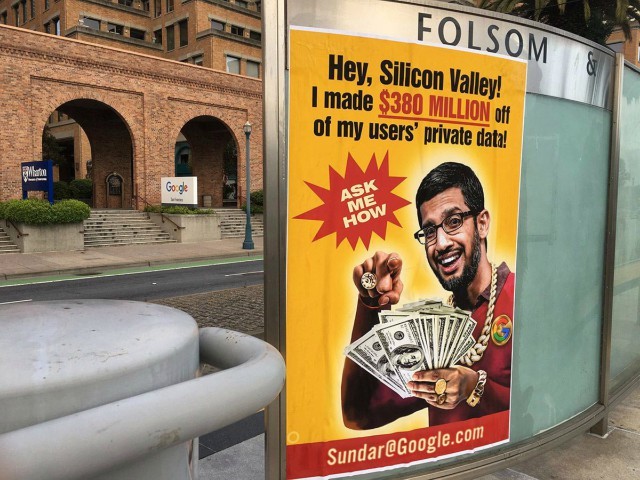

The government claims that Google increases its prices for advertisers and takes a more significant cut of publisher revenue in order to favor its own products. The complaint claims that the company retains at least 30 cents of every dollar advertisers spend using Google’s digital advertising tools. Critics contend that Google’s market dominance actually hurts consumers because they must pay inflated prices to cover the expenses brands incur for their advertising.

Google claims that it faces a lot of competition and that the Justice Department’s case mirrors one that a group of state attorneys general, led by Texas, brought against Google. The company also mentions that, at the time the DoubleClick deal took place, the federal government gave its approval. Nevertheless, detractors contend that Google’s expansive digital ad business makes the market inefficient in ways that have an impact on the cost of goods and services and that compelling the company to divest could resolve conflicts of interest that arise when a company sells ads and runs an ad marketplace.

According to Eric Franchi, a general partner at AperiamVentures, a venture firm that invests in ad-tech and marketing startups, the divestiture of portions of Google’s ad business would open up significant opportunities for new entrants. According to Fiona Campbell-Webster, chief privacy officer for advertising platform MediaMath, spinning off some of Google’s ad-tech products could improve publisher margins and increase advertisers’ reach.

Lucas Nolan is a reporter for Breitbart News covering issues of free speech and online censorship. Follow him on Twitter @LucasNolan

COMMENTS

Please let us know if you're having issues with commenting.