This morning’s key headlines from GenerationalDynamics.com

- Floating weapons armories present new terrorist threats

- Stock market continues parabolic climb with high volatility

Floating weapons armories present new terrorist threats

To perform their service, PMSCs need access to large stores of weapons– arms, ammunition, body armor, night-vision goggles, and other

military equipment. Storing this equipment on land has several problems — national governments don’t like having it there, and the PMSCs constantly have to return to home port to get the equipment.

This has given rise to an explosion of PMSCs with floating armories. These are fishing vessels, tugs, patrol boats and other weapons that have been converted by private companies into floating weapons stores. Sometimes the weapons are made available to third parties for a fee, according to Mark Gray, a director of the British company MNG Maritime:

It’s not the Hilton. As well as storing their weapons, we provide hotel services for security guards who are between jobs. We have bunk beds in cabins, the kind of accommodation they were used to during their military careers. Plus two chefs, a gym on deck and the ever essential WiFi.

It’s believed that there are currently 31 floating armories at the present time. Many are in the Red Sea and Persian Gulf, but they might be in international waters anywhere.

There’s nothing illegal about them, but they’re unregulated, and the vessels that were converted have special security features. Pirates or terrorist groups could seize the weapons, hijack the weapons, or blow them up. A recent statement by the government of India says that it stood “exposed and seriously threatened due to the presence of largely unregulated floating armories with large amounts of undeclared weapons and ammunition.” BBC and Oxford Research Group and Full Report (PDF)

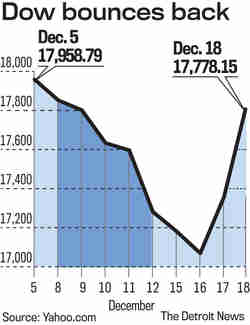

Stock market continues parabolic climb with high volatility

The drunken euphoria that I heard from analysts today, after the parabolic 421 point surge in the Dow Jones Industrial Average, is a sign of just how dangerous the situation is. They don’t seem to realize that if the Dow can go up 428 points in one day, then it can just as easily go down 428 points in one day. And with the S&P 500 price/earnings ratio at around the astronomically high 19, well above the historical level of 14, it’s only a matter of time before the stock market bubble bursts.

And that’s exactly the kind of situation that triggers a panic. These swings are getting wider and wider, just as they did prior to the 1929 crash.

The stock market fell 90% following the 1929 panic, but that didn’t happen all in one day. It fell 13% on Black Monday, and then another 12% the next day, but then it gained back 17% on the next two days, so by the end of the week, people were wondering whether it would recover

completely. But it kept relentlessly falling, and only bottomed out in the summer of 1932, despite repeated interventions by the Fed, and repeated claims by President Herbert Hoover that “Prosperity is just around the corner.”

It shouldn’t be called the “Crash of 1929,” since the stock stock market didn’t really crash in 1929. It should be called the “Panic of 1929” since, after all this time, the day that America remembers is the day of the panic, October 28, 1929. That’s how it will happen again. These wild swings will keep increasing, until one day these computerized trading computers (“algos,” as they’re now called) will take over and produce some sort of “flash crash,” and a lot of people will lose a lot of money. That will be the panic that everyone remembers. Then the stock market will partially recover, and people will cross their fingers, but the worst will be yet to come. Detroit News / AP

KEYS: Generational Dynamics, Somalia, piracy, floating armory, Private Maritime Security Companies, PMSC, MNG Maritime, Red Sea, Persian Gulf, Dow Jones Industrial Average, S&P 500 Price/Earnings ratio

Permanent web link to this article

COMMENTS

Please let us know if you're having issues with commenting.