The odds are against a recession in the next twelve months.

The U.S. economy is expanding. Unemployment is at a historically low level. Layoffs are close to the lowest level since the 1960s. The manufacturing sector is adding jobs. Retail sales are strong.

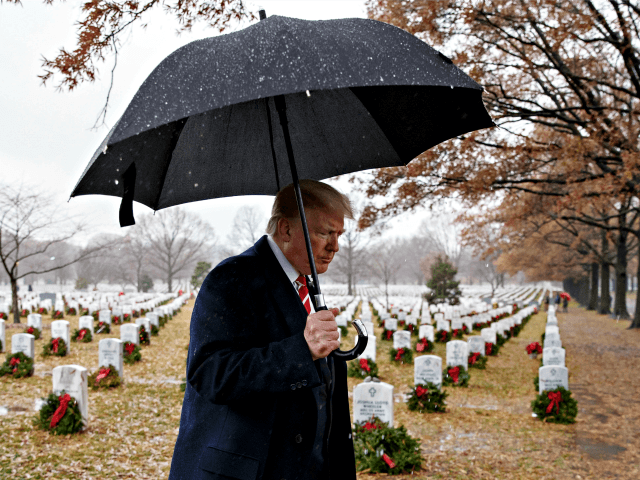

But the economic expansion is verging on being the longest since the second world war. And economies around the world have shown signs of sluggishness, in part because the Trump administration is no longer allowing them to parasitically grow off the U.S.

CNBC’s latest Fed Survey, which is a poll of 43 economists and fund managers, now has the chances of a recession in the next 12 months at 23 percent, up from 19 percent in the prior survey. The average for the Trump presidency was just 14 percent. The long-run average is 19 percent, according to CNBC.

It would be a historical anomaly for the economy to contract when unemployment is at 3.7 percent. But the economy has behaved in unexpected ways ever since the financial crisis. For years after the recession, we appeared to be in what many described as a “jobless recovery,” where the economy expanded and the stock market saw gains but few jobs were added. So perhaps it is possible to have a “job-full recession” in which GDP declines despite full-employment.

Unlikely but not impossible. Which is what a 23 percent chance of a recession indicates.

The stock market, however, may be excessively negative.

CNBC reports:

Still, many of the 43 respondents, who include economists, fund managers and strategists, also argued that the market has overdone it to the downside.

“The notion that downgraded growth prospects are driving the stock market sell-off is backwards,” wrote Mike Englund, chief economist, Action Economics. “Stock price declines have driven the growth slowdown narrative, which thus far faces little confirming evidence from actual U.S. economic reports.”

The Federal Reserve will conclude its final monetary policy meeting of the year on Wednesday. The Fed is expected to raise its interest rate target but indicate that it will raise rates next year at a slower pace than implied by its prior forecasts.

COMMENTS

Please let us know if you're having issues with commenting.