China’s ability to go toe to toe with the United States in the ongoing trade dispute was cast into doubt by economic data released this week showing an economy that had slowed down by far more than expected.

Fixed income investment, which includes spending on machinery and infrastructure, rose 5.5 percent compared with a year ago, down from 6.0 percent in the prior month. Economists had expected 6.0 percent. It was the lowest level of fixed income investment growth since 1999, before China ascended to the World Trade Organization.

Industrial production was up 6.0 percent, below the 6.3perrcent forecast. Unemployment rose to 5.1 percent last month, up from 4.8 percent in June.

Retail sales annual gains were expected to rise from June’s 9.0 percent to 9.2 percent. Instead, sales fell to 8.8 percent.

The Wall Street Journal reports:

Taken together, the data suggest that China can’t go toe-to-toe in retaliating against U.S. trade levies, said Shuang Ding, an economist with Standard Chartered Bank in Hong Kong.

“China should avoid adopting a direct, confrontational approach in the trade fight with the U.S. and focus on strengthening its economy first,” Mr. Ding said.

The U.S. economy, by contrast, is showing many signs of strength. On Tuesday, the National Federation of Independent Business reported that small business optimism had risen to just below its all-time high set back in 1983. The Atlanta Fed’s GDPNOW, a real time estimate of GDP based on the most recent economic data, has the U.S. economy growing at a 4.3 percent rate. Last quarter, the U.S. economy grew at a 4.1 percent rate, according to U.S. government data.

This is causing turmoil with elite Chinese circles. the New York Times reports:

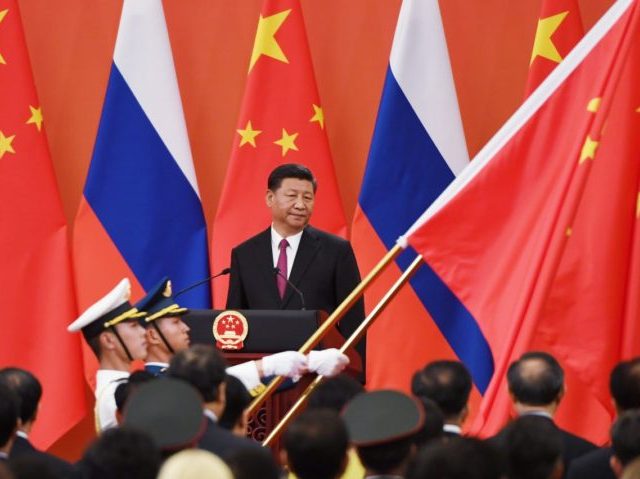

China’s leaders have sought to project confidence in the face of President Trump’s tariffs and trade threats. But as it becomes clear that a protracted trade war with the United States may be unavoidable, there are growing signs of unease inside the Communist political establishment.

In recent days, officials from the Commerce Ministry, the police and other agencies have summoned exporters to ask about plans to lay off workers or shift supply chains to other countries.

Even China’s Global Times, a state-controlled newspaper that typically trumpets China’s strength, is sounding worried notes. “Data may be worrying, but government will stick to reforms,” the Global Times reported.

“Despite complex and severe internal and external situations, China will maintain sound and stable economic fundamentals as well as a trend of transformation, upgrading and structural adjustment, Liu Aihua, spokesperson for the NBS, said at a press briefing on Tuesday,” the Global Times said.

China’s faltering growth is undermining assumptions that China’s command economy and dictatorial political system somehow makes it better able to withstand a trade dispute.

From the New York Times:

China’s leaders have argued that they can outlast Mr. Trump in a trade standoff. Their authoritarian system can stifle dissent and quickly redirect resources, and they expect Washington to be gridlocked and come under pressure from voters feeling the pain of trade disruptions.

But the Communist Party is vulnerable in its own way. It needs growth to justify its monopoly on power and is obsessed with preventing social instability. Mr. Xi’s strongman grip may be hindering effective policymaking, as officials fail to pass on bad news, defer decisions to him and rigidly carry out his orders, for better or worse.

Over at the Wall Street Journal, Nate Taplin explains:

It seems likely that misjudging the U.S.’s resolve on trade—while simultaneously overdoing the debt crackdown at home—has damaged Mr. Xi politically. What isn’t clear is how deep that damage cuts.

Regardless, a period of political horse trading now seems likely, as Mr. Xi’s emboldened opponents reassert themselves.

The U.S. is planning to implement a new, larger round of tariffs on Chinese goods, which would likely put even more pressure on China’s leaders to step back from their confrontational approach to the Trump administration.

COMMENTS

Please let us know if you're having issues with commenting.