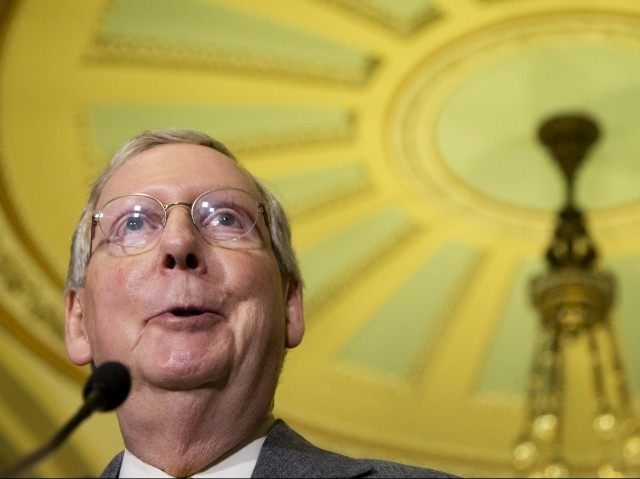

A deal on another trade-related bill seems to have cleared the way for the Senate to reach the 60-vote threshold needed to advance Trade Promotion Authority on Thursday. Senate Majority Leader Mitch McConnell (R-KY) reportedly promised that the Senate will hold a vote to reauthorize the Export-Import Bank, causing a hold-out group of senators to vote for cloture on TPA.

The Hill reports that McConnell made the promise to senators who support the Ex-Im Bank during the cloture vote Thursday. Once he made the vow the group of senators offered up key votes for the motion to pass 62-38.

“I’m glad that we have a path forward on both Ex-Im and trade. Mitch gave a commitment that we would have a vote in June,” Sen. Patty Murray (D-WA), who voted for cloture, said according to The Hill.

The Ex-Im Bank is slated to expire on June 30 if Congress does not reauthorize it, however the effort could face an uphill battle with conservatives already plotting to prevent its reauthorization.

Indeed, Thursday morning, the conservative Republican Study Committee announced its official position against Ex-Im’s reauthorization.

“Ex-Im boasts a disturbing culture of corruption and misconduct that has led to numerous criminal indictments in the last six years,” RSC Chairman Bill Flores (R-TX) said in a statement.

Their lending standards often lack transparency and consistency. Yet rather than address these mounting problems, bank officials have repeatedly ignored required reforms from Congress and recommendations from the Government Accountability Office and the bank’s own Inspector General. We need to end Ex-Im before it becomes another Enron at the expense of American taxpayers.

While the sides are lining up for and against Ex-Im, for Thursday’s vote, a promise to bring it to a vote next month helped McConnell advance fast-track.

“We just want people to stand up and be counted in June before the bank expires,” Sen. Maria Cantwell (D-WA) who voted for cloture after McConnell promised a vote, according to The New York Times.

COMMENTS

Please let us know if you're having issues with commenting.