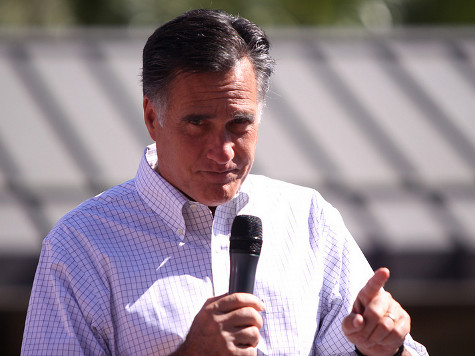

The latest attack on Mitt Romney’s time at Bain Capital appeared this week at Vanity Fairby author Nicholas Shaxson. While the article is ostensibly aninvestigation into Mitt Romney’s offshore accounts, a close look at thereporting shows it is mostly a rehash of older reports and revealsseveral instances where the author failed to offer readers a broaderperspective on the issues at hand.

The opening section of thestory reports on Romney’s offshore accounts in places like Grand Cayman.Much of this material was reported three months agoby the Washington Post. In case there’s any doubt he was familiar withit, Shaxson quotes the Post piece at one point to claim that experts onboth sides of the aisle agree Romney hasn’t been sufficientlytransparent with his tax returns. What Shaxson omits from the WashingtonPost report is any mention that Democrats like former Presidentialcandidate John Kerry were similarly inclined:

…since the 2004 campaign — when Democratic presidential candidate JohnKerry declined to disclose some of his wife’s holdings — the Office of Government Ethicshas permitted nominees and presidential candidates to postponerevealing underlying assets in investment accounts that have a legallybinding confidentiality agreement.

There areother odd omissions in the Vanity Fair piece. For instance, thediscussion of the tax rate Romney pays on his income, which is about 15percent, fails to mention the ongoing political debate over the “BuffettRule,” which President Obama has been pushing for nearly ayear:

Romney manages this low rate because he takes his payments from BainCapital as investment income, which is taxed at a maximum 15 percent,instead of the 35 percent he would pay on “ordinary” income, such assalaries and wages. Many tax experts argue that the form of remunerationhe receives, known as carried interest, is really just a fee charged byinvestment managers, so it should instead be taxed at the 35 percentrate. Lee Sheppard, a contributing editor at the trade publication Tax Notes,whose often controversial articles are read widely by taxprofessionals, is nonplussed that the Obama campaign has been solistless on the issue of carried interest. “Romney is the poster boy,the best argument, for taxing this profit share as ordinary income,”says Sheppard.

Shaxson quotes “controversial” economic analyst Lee Sheppard. Sheppard is an acknowledgedexpert in tax policy who has been advocating consistently for thisparticular change since at least 2006. This NY Times profileof Sheppard from 2007 is more descriptive of the kind of controversythat exists about her work: “A lot of people would tell you that [heranalyses] are skewed toward thegovernment’s way of looking at things and that she frequently does notgive the taxpayer’s side.”

But that’s really the least of theproblems with this account. Raising capital gains taxes isn’t just a taxissue among policy wonks; it’s a political football. The President had Warren Buffett’s secretary sit next to the First Lady at his State of the Union to highlight the issue. NPR described it as the President’s “rallying cry” this tax season. So whywould Shaxson talk around the issue and its connection to Romney’s presidential aspirations without mentioning the wider political contextof the debate? The fact that Sheppard is considered pro-government (bysome) and that this issue has been a crusade of President Obamacertainly seems relevant and worthy of a mention.

One of themost striking claims in the Vanity Fair piece is aimed squarely atRomney’s credentials as a businessman based on his Bain Capital work:

It is substantially on this stellar record that Romney is nowrunning for president. His work at Bain was unquestionably good forhimself and for Bain, but was it also good for the businesses heacquired, for their workers, and for the economy, as he claims?

Areport by Bain and Co. itself, looking at the period from 2002 to 2007,concluded that there is “little evidence that private equity owners,overall, added value” to the companies they took over: nearly all theirreturns are explained by broad economic growth, rising stock markets,and leverage.

The suggestion here is that Romney’swork at Bain Capital is a fraud. However, Shaxson performs somesleight-of-hand to reach this conclusion. First of all, Romney left BainCapital in 1999, so the period looked at by the Bain and Co. report didnot cover his tenure in the industry. That is significant, because the articlefrom which Shaxson took the quote about private equity suggested thisparticular period of time (2000-2007) was distinct in the industry: “Inthe benign period that preceded the downturn, private equity firmsdid not have to put much muscle into generating attractive returns.”Shaxson also leaves out this caveat in the Bain and Co. report: “Clearly,some industry leaders did create value in their portfoliocompanies, and their active ownership was rewarded with superiorreturns.”

A GAO report covering the same time periodas the Bain report Vanity Fair relies on found: “Academic studiesanalyzing LBOs done in the 2000s suggest that private equity-ownedcompanies usually outperformed similar companies not owned by privateequity firms across a number of benchmarks, such as profitability,innovation, and the returns to investors in IPOs.” The GAO report doessay it is difficult to tease out the threads of this performance. butsome areas, such as innovation, seem fairly cut and dry.

Astudy of U.S. patents found that private equity-owned companies pursuedmore economically important innovations, as measured by how often thepatents are cited by later patent filings, than similar companies. Thisfinding also suggests that private equity-owned companies are willing toundertake research activities that can require a large up-front costbut yield benefits in the longer term.

Thisis at odds with the views of private equity Shaxson paints in hisarticle. Josh Kosman, a critic of private equity, is the source of muchof this material. A significant portion of the Vanity Fair piece, a case study of medical device manufacturer Dade Behring, isrehashed from this 2009 Boston Globe op-ed by Kosman. More recently, Kosman has labeled firms like Bain Capital “the worst of Capitalism” in an article at Rolling Stone, a magazine not know for its friendliness toward Republicans.

Theremay be some validity to Kosman’s criticisms of private equity ingeneral and Bain in particular, but Shaxson devotes his piece to criticslike Kosman and Sheppard, allowing no space for supporters of theindustry to rebut their claims. The VF article notes parentheticallythat Bain Capital refused to speak to him for the story, but surely someone could have been called upon to support the industry?

The Vanity Fair pieceis mostly a rehash of criticisms from other publications, one which notonly fails to provide a response from those within the industry butwhich often excludes mitigating language in the sources it does rely on.In any case, Vanity Fair is going to have a hard time pressing this attack on private equity when President Obama is on the record describing private equity as “the best opportunity forlong-term economic vitality, for the expansion of jobs, forthe improvement of productivity and a quality standard of living.”

COMMENTS

Please let us know if you're having issues with commenting.