Minutes from the Federal Reserve’s end of January meeting reveal that Fed officials are split over how long to continue making $85 billion monthly bond purchases in an attempt to stimulate the U.S. economy.

Some officials in the meeting warned the Fed could face “significant capital losses” and “possible complications” if the Fed tries to dump the bonds in a sell-off that could rattle financial markets. Others said the Fed’s monetary pumping could spark “excessive risk-taking and adverse consequences for financial stability.”

Markets reacted negatively to the Federal Reserve meeting minutes, dropping 100 points in the Dow Jones shortly after their release.

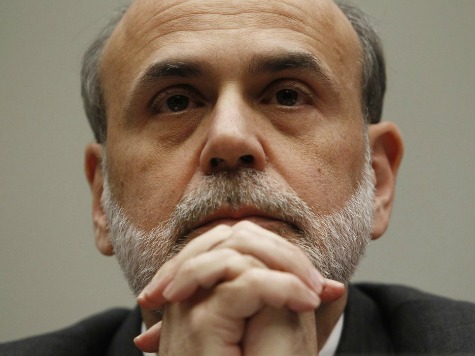

But the Fed’s so-called “quantitative easing” (QE) policy is likely to continue, despite the concerns expressed in last month’s meeting. Both Chairman Ben Bernanke and Vice Chairman Janet Yellen favor the bond-buying scheme, and those who oppose the Fed’s stimulus policy lack a vote on the Fed’s policy-setting panel.

“It is not an even discussion in the sense that these two sides on the committee do not have equal weight,” said chief economist at Barclay’s Capital in New York Dean Maki. “Bernanke and Yellen are strong advocates of QE.”

Since 2008, the Fed has more than tripled the size of its portfolio of assets to $2.861 trillion.

COMMENTS

Please let us know if you're having issues with commenting.