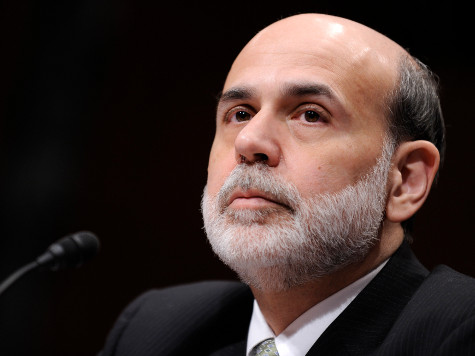

Most of the coverage of Bernanke’s testimony in front of the Senate Banking Committee today has been focused on his gloomy economic outlook. That was interesting, to be sure, but it really was just further confirmation about what we already know about the economy. The most unsettling part of his testimony to me was when he acknowledged that the Fed had known about the LIBOR bank scandal four years ago. For four years he knew that banks were manipulating one of the most important financial measurements and yet Bernanke did nothing.

From The Associated Press:

Federal Reserve Chairman Ben Bernanke learned from news reports four years ago that banks were manipulating a key British interest rate. But Bernanke said Tuesday that the Fed was powerless to do anything beyond contacting British authorities.

LIBOR, the London interbank offering rate, is the rate banks charge each other to lend money. It is the benchmark for virtually every other financial instrument, from derivatives to mortgages. My colleague Wynton Hall reported that LIBOR is used to set $800 trillion in financial instruments. Think of it as a kind of financial pi.

The Economist calls it the biggest banking scandal in history:

If attempts to manipulate LIBOR were successful–and the regulators think that Barclays did manage it, on occasion–then this would be the biggest securities fraud in history, affecting investors and borrowers around the world. That opens the door to litigation not just by the direct customers of implicated banks, but by anyone with a financial interest in LIBOR.

If banks were manipulating LIBOR, as seems clear, it would have ripple effects throughout the entire financial sector. It’s almost impossible to calculate the overall costs to the market. It’s also impossible to calculate the irresponsibility of doing almost nothing about the manipulation.

Bernanke said that current Treasury Secretary Tim Geithner briefed some US officials about the manipulation. He also said that the Fed notified the British banking authorities of the scandal, but that they didn’t have the authority to do anything else. Invoking the “Joe Paterno defense”, Bernanke defended his actions:

“I think the responsibility of the New York Fed was to make sure the appropriate authorities had the information, which is what they did,” he said.

You know who could have really used the information? Consumers. Anyone with any kind of credit product is affected by manipulations of LIBOR. I understand that Bernanke didn’t have express authority to “do something” about the manipulation, as in statutory or regulatory authority. But, you know what he did have the authority to do? Call a press conference. Public outcry that bankers were gaming the financial system provides the ultimate authority to remedy the scandal.

What progressives continually fail to understand is that you can have 30 Dodd-Frank “reform” efforts, but if regulators are in at least tacit collusion with corrupt bankers, the entire regulatory edifice is pointless.

The Obama Administration has known from day-one that some banks were manipulating a foundation of the financial system for their own benefit. And they did nothing.

Follow me on twitter here.

COMMENTS

Please let us know if you're having issues with commenting.